Application

Pre-qual, 1003, and FNM export

Seamless, automated loan applications

Seamless, automated loan applications

-p-1600.webp)

Overview

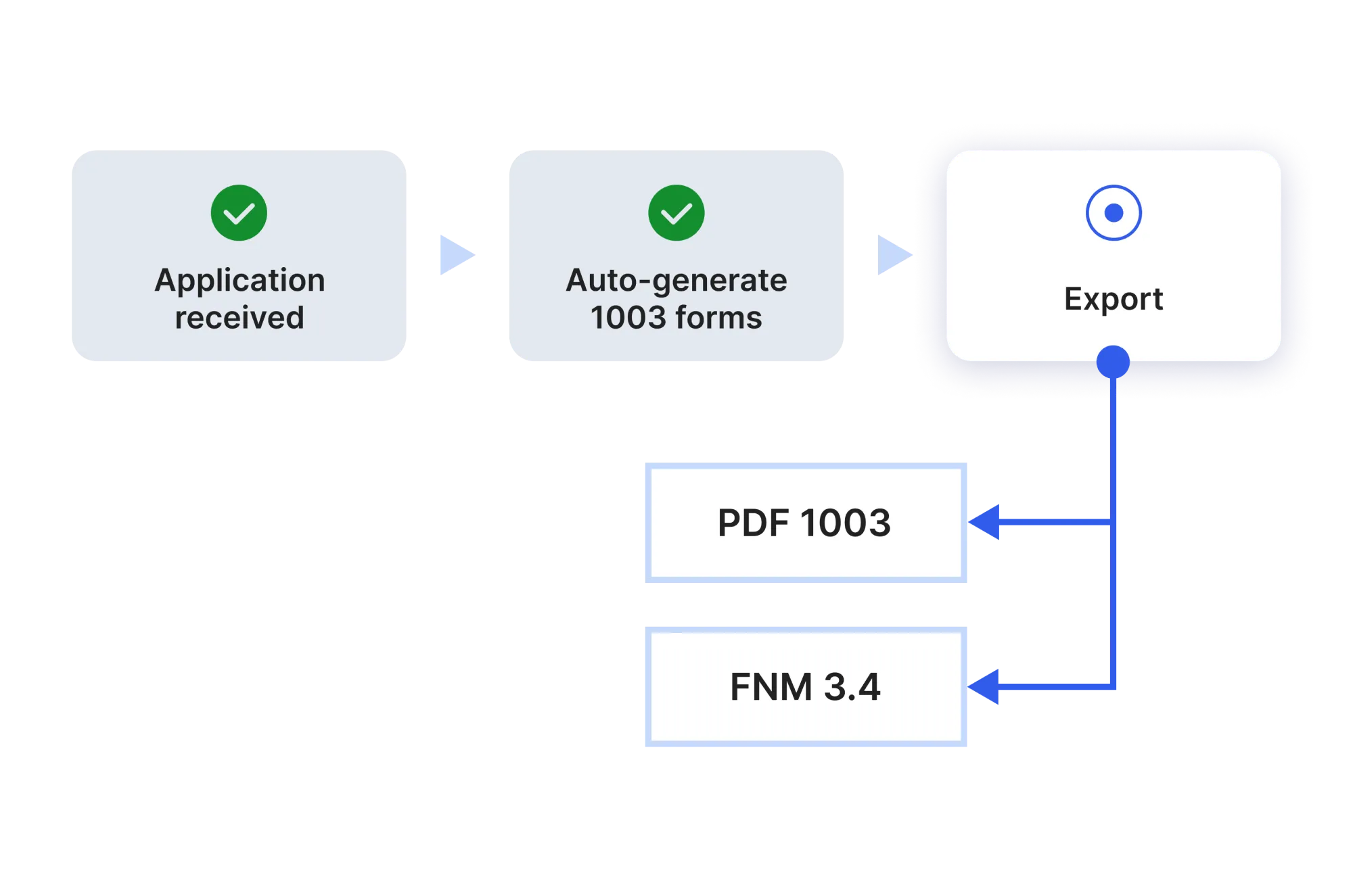

From pre-qualification to final submission, Zeitro’s Application system automates every step of the borrower application process. Borrowers can pre-qualify online, complete the 1003 form with ease, and export their data in FNM 3.4 format for seamless integration with lenders.

Key features

Self-service pre-qualification

Allow borrowers to pre-qualify themselves online, reducing manual work and improving conversion rates.

%201.webp)

Automated DTI calculation

Calculate a borrower’s Debt-to-Income (DTI) ratio instantly and accurately using AI-driven tools. Zeitro automatically pulls in borrower financial data and computes the DTI in real-time, ensuring precision in pre-qualification and loan

%201.webp)

1003 automation

Automatically generate 1003 forms based on borrower data, minimizing errors and manual input.

%201%20(1).webp)

FNM 3.4 Export

Easily export borrower data in FNM 3.4 format, ensuring compatibility with lender systems and faster loan processing.

Real-time credit checks

Run borrower credit checks instantly to provide accurate pre-approval results.

%201.webp)

%201.svg)

%201.svg)

%201%20(1).svg)

%201.svg)

Why it matters

By automating the application process, Zeitro reduces the time and effort needed to move a borrower through pre-qualification to final approval. This not only speeds up loan processing but also enhances the borrower experience, making it easier for them to complete applications.

I just tried Zeitro’s Scenario AI, and it’s incredibly easy to use—especially for searching complicated borrower cases. I looked up a scenario where the borrower had no income or business, and the answer I got matched exactly what I learned after a 30-minute conversation with an AE from AAA. It even included a reference paragraph. It’s amazing!”

Gigi Zhang

RateDNA, Mortgage Broker

RateDNA, Mortgage Broker

.webp)