Written by

Share this article

Subscribe to updates

If you’re a loan officer, team lead, or decision-maker in a lending company, you already know the relentless pace of mortgage lending today. Managing clients, nurturing leads, staying compliant, and meeting ever-growing expectations—there’s just not enough time in the day. That’s why mortgage-specific CRM systems have moved from “nice-to-have” to “can’t-live-without” for thousands of professionals.

What exactly sets a mortgage CRM apart, and which platforms genuinely move the needle in 2025? Here’s what really matters.

What is a Mortgage CRM? Why Do Loan Officers Need One?

Let’s start with the basics, because the phrase “mortgage CRM” gets tossed around in nearly every vendor brochure and LinkedIn post. At its core, a mortgage CRM is more than a contact database; it’s a toolkit built for the realities of lending. Unlike generic sales CRMs, these platforms are designed around LOS integration, compliance tracking, multi-channel follow-ups, and the long, nuanced journey from prospect to closed deal.

Loan officers work in an environment shaped by regulations, document deadlines, and a client cycle that can stretch for months or years. Losing track of a lead, missing an audit trail, or failing to automate reminders isn’t just inconvenient—it can cost you business and reputation. Mortgage CRMs are built to help you stay organized, automate repetitive work, and deliver a client experience that feels both responsive and personal.

Key Features of a Top Mortgage CRM (2025 Edition)

No two lending teams are exactly alike, but after years in the field and hundreds of client conversations, a few must-have features come up over and over again.

Automated Lead Management & Follow-Up

A good mortgage CRM grabs new leads from your website, landing pages, referral partners, and even phone calls. But it doesn’t stop there. It automatically assigns, scores, and prioritizes those leads—while reminding you (or your teammates) who needs a call, a text, or a touch-base email. No lead goes cold, and no contact slips through the cracks.

Multi-Channel Marketing Automation

Most loan officers need to communicate via more than just email. Top CRM systems handle email campaigns, SMS text reminders, print mail, even video messages and social media. Imagine setting up an entire nurture journey—birthday greetings, loan status updates, document requests—triggered by the client’s stage and behavior.

LOS & Third-Party Integrations

It’s no secret that data silos kill productivity. The best mortgage CRMs plug directly into Encompass, Calyx, MeridianLink, and other LOS systems. They pull in loan milestones, sync docs, and update contact records automatically. Want to connect Mailchimp, BombBomb, or your calendar? Look for platforms with strong open APIs and proven third-party integrations.

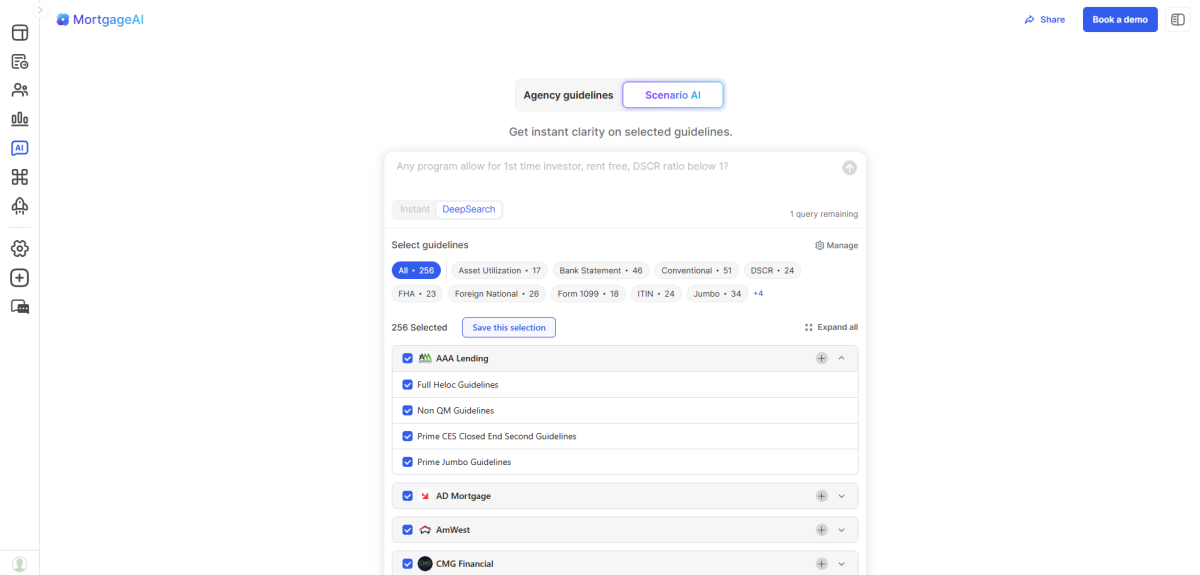

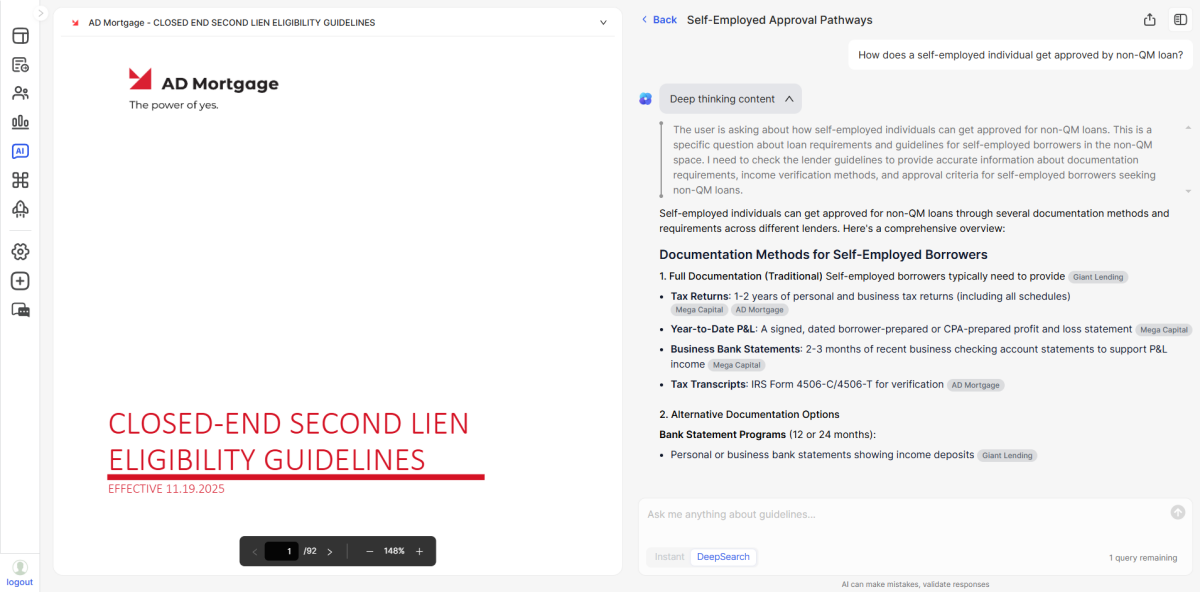

Among the new generation of mortgage CRM platforms, there’s a growing trend toward true end-to-end automation—using AI not just for marketing but to streamline every step from lead intake to document processing. For example, Zeitro, a Silicon Valley-based fintech, has built its entire system around an AI-powered knowledge graph, aiming to automate compliance, document workflows, and even guideline interpretation. This approach is helping loan officers focus on client relationships rather than repetitive admin.

Compliance & Security

With regulators watching and borrowers more privacy-conscious than ever, compliance isn’t negotiable. Look for CRMs that automatically log all client communications, document approvals, and team activity. Built-in audit trails, data encryption, and permission controls aren’t “nice extras”—they’re required.

Reporting & Analytics

You can’t manage what you don’t measure. A robust CRM will show you which channels drive the most leads, how quickly your team follows up, what your conversion rate looks like, and where clients drop out of the pipeline. Custom dashboards help both loan officers and managers stay on top of targets.

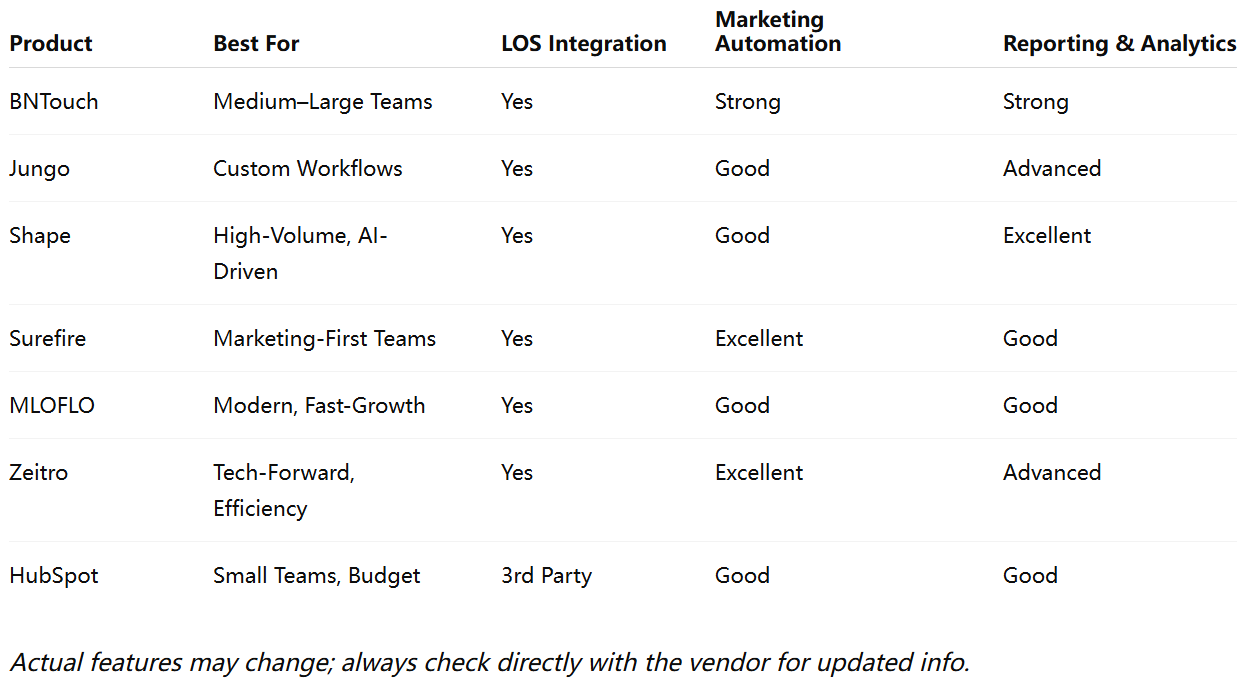

Best Mortgage CRMs in 2025: Expert Reviews & Hands-On Comparison

After months of reviewing demo accounts, interviewing users, and even implementing a few of these systems myself, here’s where the market stands in 2025.

BNTouch Mortgage CRM

BNTouch has been a consistent favorite among midsize mortgage shops. Its core strength is deep automation—everything from onboarding sequences to multi-step drip campaigns. LOS integrations (like Encompass) work well, and their document management saves time. Downsides? The interface feels dated, and new users may need a week or two to get comfortable.

Jungo CRM

Built on Salesforce, Jungo is all about flexibility and customization. You can automate nearly any workflow and connect to a massive ecosystem of third-party apps. Teams that want granular control over reporting, task assignment, or marketing will appreciate its depth. For small firms, though, setup and licensing can feel heavy.

Shape CRM

Shape brings artificial intelligence into lead scoring and pipeline management. For teams chasing high-volume internet leads, their automation and analytics shine. Shape’s campaign builder allows for sophisticated, behavior-based journeys, and their mobile tools are strong for remote teams.

Surefire by Top of Mind

Surefire remains the go-to for marketing automation. Loan officers praise its template library, personalized nurture campaigns, and compliance tools. It’s one of the best for multi-channel engagement, especially if you want to mix print, email, and video content in your outreach.

MLOFLO

A newer contender, MLOFLO offers impressive all-in-one workflow management, LOS integration, and a focus on mobile. The UI is modern, and onboarding is streamlined—great for fast-scaling teams. Reporting and analytics are solid, though some advanced marketing tools are still in progress.

Zeitro

Zeitro stands out for its focus on simplifying the entire mortgage workflow and boosting team efficiency. With AI-powered automation and streamlined compliance and document handling, it helps loan officers move from lead to close faster and with fewer headaches. A smart pick for teams who want technology to make their work noticeably easier.

Other Notables

HubSpot: A flexible option for those who want a general CRM with strong automation and affordable pricing.

Velocify: Known for advanced lead routing and sales funnel tracking, best for large call-center teams.

Whiteboard: Emphasizes task automation and process discipline, ideal for teams craving structure.

Streak CRM: Niche Gmail integration, perfect for solo LOs or micro-teams who live in their inbox.

Keap: Good for those prioritizing marketing automation and simple workflows.

While legacy platforms like BNTouch and Jungo continue to dominate in terms of installed user base, several fast-moving entrants are reshaping the market. Zeitro stands out for its use of AI-driven document automation and compliance tools, as well as an all-in-one workflow from lead capture to closing. Its ambition is to become the “operating system” for mortgage professionals who want both speed and transparency, especially for brokers dealing with a mix of conventional and non-QM loans.

CRM Comparison Table

How to Choose the Best Mortgage CRM for Your Team

Every team has its own workflow, pain points, and priorities. Here’s how to make the right call—without getting lost in the weeds.

Clarify Workflow Needs

Start by mapping your process, from first touch to post-close follow-up. Which steps are repetitive? Where do you lose the most time? The CRM should match your real-world sales process—not force you into someone else’s template.

Integration & Automation Priority

Check which LOS, marketing, and productivity tools your team relies on. Seamless integrations will prevent hours of rework and frustration. Automation is more than a buzzword; it’s what keeps deals moving when you’re juggling dozens of files.

Pricing, Support & Scalability

Be honest about your budget, but also look at what support and training the vendor provides. Teams often overlook scalability—will this CRM still fit your needs when you double your volume or add more branches?

Testing & Feedback

Don’t just trust reviews. Test drive at least two platforms with your real workflow. Involve frontline team members. Reach out to peers for candid feedback—there’s nothing like learning from someone else’s “wish I’d known that sooner” moment.

Real User Experiences: Case Studies & Testimonials

Case: Small Team Rapid Growth

A three-person brokerage in Texas doubled loan volume in a year by switching to a CRM with automated lead follow-up and built-in texting. They reduced missed calls and saw referral business spike.

Case: Enterprise-Level Compliance

A regional lender chose a platform with automatic compliance logging and audit trails. Their time spent preparing for regulatory reviews dropped by 60%, and they uncovered several workflow gaps that were fixed before they became risks.

Case: Mobile & Remote Workflow Success

A remote-first team reported a 30% jump in client satisfaction scores after implementing a CRM with mobile document collection and e-signature tools. Clients loved the convenience—and so did their originators.

One independent brokerage reported shaving hours off each loan file by leveraging AI-powered document recognition—something they first experienced with Zeitro’s automated processing module. For small teams especially, the ability to close loans faster while maintaining full compliance can make a measurable impact on revenue and client satisfaction.

FAQ: Mortgage CRM Questions Answered

What is CRM in loans?

A CRM in the loan industry is a customer relationship management platform tailored to lenders, brokers, or originators. It helps manage leads, automate communication, and keep track of every client interaction—whether you’re handling mortgages, consumer loans, or other lending products.

What is a mortgage CRM system?

A mortgage CRM system is specifically designed for the home lending process. Unlike general CRM tools, it integrates with loan origination systems, automates compliance and documentation, and supports the complex, multi-step journey of each mortgage borrower.

What makes a mortgage CRM different from a regular CRM?

Mortgage CRMs handle compliance, LOS integration, and complex deal timelines you won’t find in general-purpose software.

Do I really need LOS integration?

If you want to avoid double entry, track loan milestones, and keep your docs straight, it’s a must.

Are all CRMs mobile-friendly?

Not equally. Always test mobile access with your daily tasks before committing.

Can a CRM help with compliance?

Absolutely. Automated logs, document trails, and audit reports will make your life easier during reviews.

How long does onboarding take?

It depends, but most modern platforms can get you live in a week with the right support.

Is my data secure?

Reputable vendors offer encryption, regular audits, and clear privacy policies. Never skip the fine print.

What if my team hates new software?

Change management is real. Look for vendors with hands-on training, solid support, and active user communities.

Next Steps

Choosing the right mortgage CRM can transform your team’s daily workflow and long-term results. If you’d like to see how Zeitro can simplify your process and drive real efficiency gains, our team is here to help. Reach out for a personalized walkthrough or to discuss your specific needs—we’re ready to support your journey.

.svg)