Written by

Share this article

Subscribe to updates

What Is Loan Origination Software And How Does It Work?

Loan Origination Software (LOS) is a digital platform that automates and manages the entire loan application process—from the borrower’s initial application through underwriting, approval, and funding. Instead of relying on manual paperwork and disconnected systems, LOS centralizes data, streamlines workflows, and ensures regulatory compliance. For lenders, this reduces processing time and operating costs, while for borrowers, it provides a faster and more transparent loan experience. For example, Zeitro integrates AI-driven workflows and real-time risk scoring to significantly cut down processing time while minimizing errors, ultimately delivering higher operational efficiency for institutions.

Who Needs Loan Origination Software?

Loan Origination Software (LOS) is designed for a wide range of lending participants, including lenders, brokers, and financial institutions that handle large volumes of loan applications—such as banks, credit unions, mortgage companies, and fintech firms. Whether it’s a large national bank or a smaller community-based lender, LOS can help improve operational efficiency, reduce human errors, and support scalable growth. Even newer lending platforms, like peer-to-peer (P2P) lenders or online financing providers, can leverage LOS to deliver a faster, more transparent, and more digital loan experience to their customers.

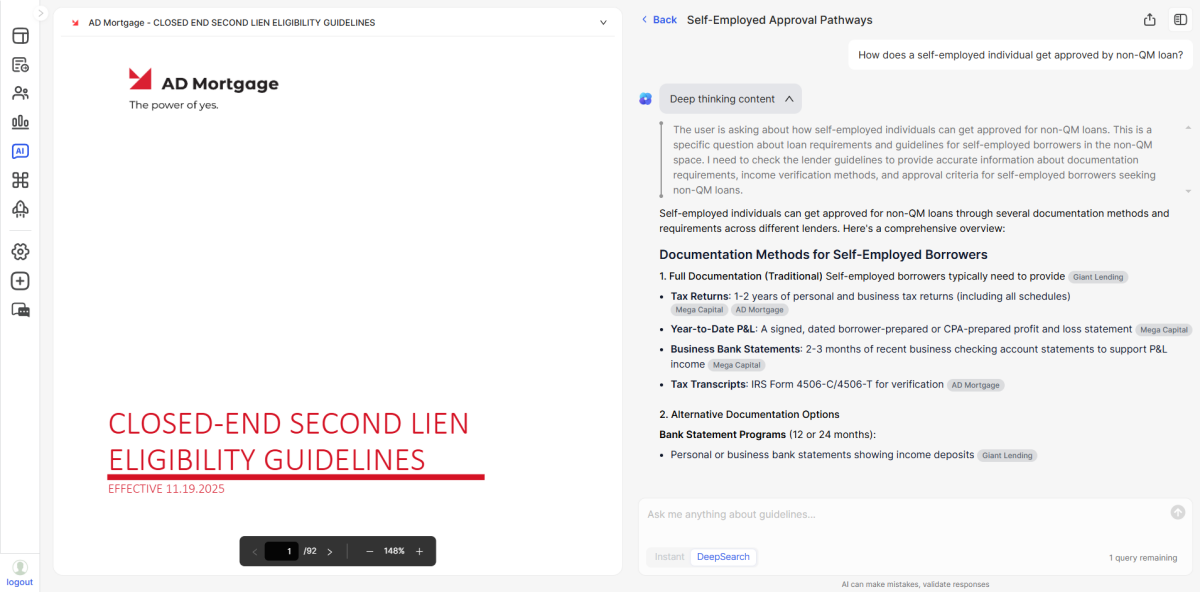

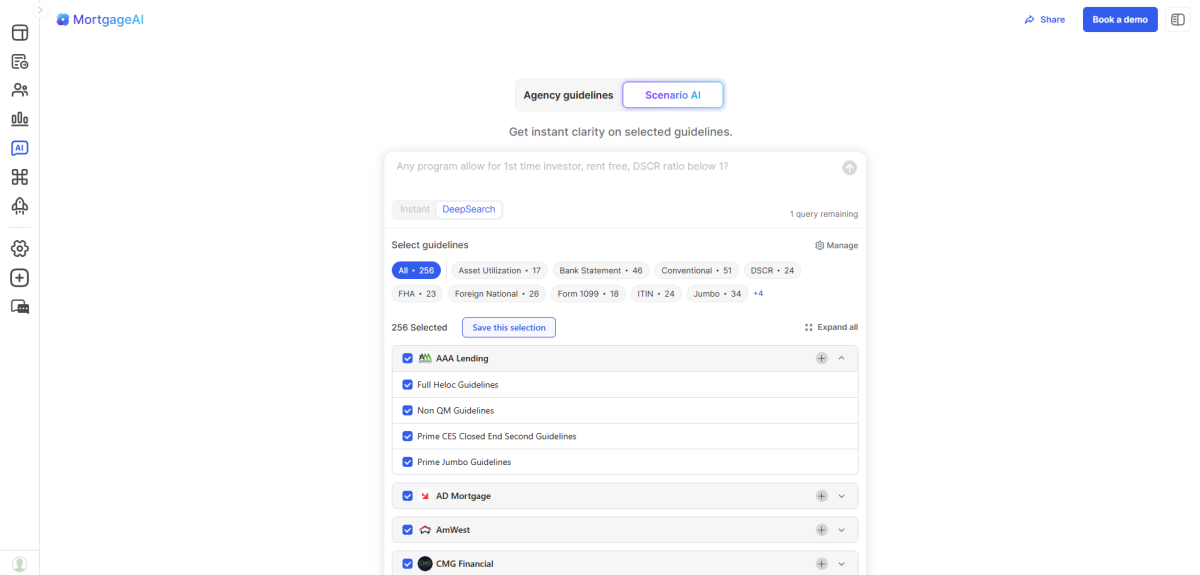

As the digital transformation of lending accelerates, LOS is becoming an essential tool for financial institutions seeking to improve both efficiency and customer experience. In line with this trend, Zeitro offers an AI-powered, end-to-end platform that goes beyond traditional LOS capabilities. With features like GuidelineGPT, automated document processing, and a modern borrower portal, it enables faster approvals, greater accuracy, and a smoother borrower journey.

Next, let’s take a closer look at how LOS helps lenders streamline the loan process more effectively.

How Does Loan Origination Software Help Lenders?

Accelerate Loan Processing and Speed Up Funding

Loan origination software can significantly shorten the loan processing cycle. Traditional loan approvals often depend on extensive manual reviews and paper-based documentation. By contrast, LOS uses automated workflows to connect every stage—application, document collection, credit assessment, and approval—into a seamless process. This not only enables lenders to complete approvals more quickly but also allows borrowers to access funds faster, resulting in a far better overall experience.

Centralized Collaboration to Cut Costs and Boost Efficiency

LOS brings all lending processes together on a single, unified platform, reducing the need for repetitive communication and back-and-forth information sharing between departments. Loan officers, risk managers, and compliance teams can collaborate in real time within the same system, which minimizes redundant work and optimizes resource allocation. For lending institutions, this translates into lower labor costs and greater processing capacity.

Automated Validation for Higher Accuracy and Regulatory Compliance

Loan origination software leverages automated data validation and rule-based engines to greatly reduce the risk of human error. For example, the system can automatically verify the completeness of borrower information, flag inconsistent data, and ensure that every step aligns with regulatory requirements. This not only lowers loan rejection rates but also helps lenders avoid potential compliance risks.

Key Features of Loan Management Software

Loan Origination & Processing

At the core of LOS is loan origination and processing, enabling borrowers to submit applications online while the system automatically collects required documents and performs preliminary checks. With optimized workflows, loan officers can track application status in real time and process approvals quickly. This shortens the time from application to disbursement and improves overall responsiveness.

Automation & Workflow Management

Automation and workflow management reduce manual intervention and boost operational efficiency through intelligent workflows. LOS can automatically assign tasks based on predefined rules, issue approval reminders, and leverage AI-powered decision engines to score and prioritize applications. This allows lenders to make faster and more accurate lending decisions while minimizing human error.

Compliance & Security

Compliance and security features ensure that all lending operations meet regulatory requirements. The system can automatically generate compliance reports, monitor suspicious activities within the loan process, and encrypt sensitive data to protect both borrower and institutional information. Centralized data storage and controlled access further reduce the risk of data breaches or unauthorized actions, providing a strong layer of security for lenders.

Risk & Credit Assessment

Risk and credit assessment functions leverage automated credit checks, risk scoring models, and real-time data analytics to thoroughly evaluate borrower creditworthiness and potential default risks. The system generates detailed risk reports and supports multi-dimensional risk management strategies, helping lenders reduce default rates and safeguard institutional assets.

Document & Data Management

Document and data management digitizes the entire loan lifecycle. All loan-related documents are stored, retrieved, and shared within the system. Through a centralized database, institutions can easily track historical records and approval statuses, while cloud-based access and remote collaboration make it simple for branches and regional offices to process loans efficiently.

Scalability & Integrations

Scalability and integration capabilities ensure LOS can adapt to business growth with ease—whether by handling higher application volumes or adding new product lines. The system also integrates seamlessly with third-party services such as credit bureaus, payment gateways, and fraud detection platforms. This creates a connected ecosystem that enhances flexibility and operational efficiency.

Borrower & User Experience

Borrower and user experience features are designed to simplify the lending process with user-friendly portals and mobile apps. Borrowers can check application status, upload documents, and communicate with loan officers anytime. Seamless digital interactions and intuitive tools improve customer satisfaction and loyalty, helping lenders stand out in a competitive market.

Reporting & Analytics

Reporting and analytics deliver real-time business data and multi-dimensional insights, covering loan approval efficiency, risk exposure, and borrower behavior. Institutions can use these insights to refine business strategies, strengthen risk controls, and respond quickly to market shifts—enabling data-driven decision-making and continuous improvement.

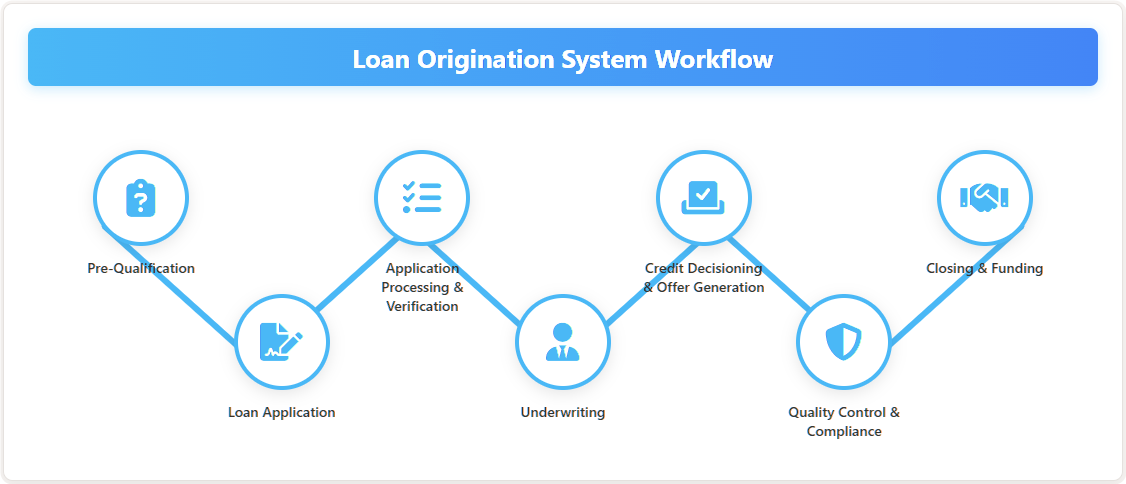

Loan Origination System Workflow

Loan Origination Systems (LOS) are designed to automate and optimize the entire lending process, improving efficiency, accuracy, and regulatory compliance. Below is a typical LOS workflow:

- Pre-Qualification

In the pre-qualification stage, lenders quickly assess a borrower’s eligibility based on basic financial information such as income, credit score, and existing debt obligations. This step helps filter out ineligible applicants early, saving time for both the borrower and the lender.

- Loan Application

At the loan application stage, borrowers submit a formal application that includes detailed personal, financial, and employment information. Modern LOS platforms typically offer online application portals, making the process faster and more convenient.

- Application Processing and Verification

Once submitted, the system verifies the borrower’s information, including identity documents, proof of income, employment details, and other supporting records. Automated workflows minimize manual intervention and improve accuracy during this stage.

- Underwriting

Underwriting involves assessing the borrower’s credit risk. LOS analyzes credit reports, debt-to-income ratios, and other financial indicators. Advanced systems may also leverage AI-driven risk scoring to deliver faster and more precise underwriting decisions.

- Credit Decisioning and Offer Generation

Based on underwriting results, the system generates a credit decision. If approved, LOS produces a loan offer that outlines the interest rate, repayment schedule, and terms. Some platforms also support conditional approvals or requests for additional documentation.

- Quality Control and Compliance

Before final approval, LOS runs quality checks to ensure all processes comply with regulatory requirements and internal policies. This stage helps prevent operational errors and reduces compliance risks.

- Closing and Funding

The final stage includes signing loan documents and disbursing funds. Modern LOS platforms often support e-signatures and automated fund transfers, ensuring a smooth and timely loan closing process.

Loan Origination System vs. Loan Management System: What’s the Difference?

Although they are often mentioned together, a Loan Origination System (LOS) and a Loan Management System (LMS) play very different roles in the loan lifecycle.

A Loan Origination System (LOS) mainly focuses on the front-end process of lending—starting from when a borrower submits an application, followed by identity and credit verification, risk assessment, and approval. Its core purpose is to streamline decision-making, reduce manual errors, and ensure regulatory compliance. For example, mortgage lenders rely on LOS to automate document collection, run eligibility checks, and generate approval workflows.

A Loan Management System (LMS), on the other hand, concentrates on the post-approval stage. Once loan funds are disbursed, LMS manages repayment schedules, interest calculations, collection processes, customer communication, and delinquency monitoring. It is the core tool for loan servicing, ensuring borrower account data accuracy while helping lenders efficiently track outstanding balances and risk exposure.

In short, LOS helps lenders originate loans faster and more efficiently, while LMS ensures that those loans are properly serviced and managed throughout their lifecycle. Many financial institutions use both systems together to provide borrowers with an end-to-end lending experience—from application to final repayment. However, a new generation of AI-driven platforms is working to break this divide by integrating LOS and LMS functionalities into a single end-to-end system. Zeitro is one such example, offering a unified architecture that reduces the complexity of switching between multiple systems, enabling institutions to speed up approvals while also managing post-loan servicing more efficiently.

FAQ

What Are The 5 C's Of Loans?

The “Five C’s” of lending are the core standards banks use to evaluate a borrower’s creditworthiness. They include:

Character: The borrower’s integrity and willingness to repay, usually assessed through credit history, employment background, and past borrowing behavior.

Capacity: The borrower’s ability to repay the loan, evaluated through income, debt obligations, and cash flow.

Capital: The borrower’s own funds or net worth, reflecting financial stability and the ability to take on risk.

Collateral: Assets pledged by the borrower, such as property or vehicles, used to reduce lending risk.

Conditions: Loan purpose, interest rate, repayment term, and the overall economic environment, all of which influence lending decisions.

By considering these five C’s, banks can comprehensively assess a borrower’s risk level and make sound lending decisions.

What Are the Three Main Components Of a Loan?

A loan typically consists of three main components:

Principal: The actual amount borrowed, which serves as the basis for interest calculation.

Interest: The cost of borrowing, paid to the lender, usually calculated at a fixed or variable rate.

Term: The repayment period and total duration of the loan, including installment schedules and the maturity date.

Understanding these three components helps borrowers plan their repayments effectively and manage the true cost of a loan.

Should I Choose a Cloud-Native LOS?

A cloud-native Loan Origination System (LOS) is specifically designed for cloud environments and offers several advantages over traditional on-premise systems:

Scalability: Easily expand as loan volumes increase without additional hardware.

Accessibility: Access the system from anywhere, improving collaboration across branches.

Automatic Updates: Regular cloud updates ensure compliance and security.

Lower IT Costs: Reduce expenses on servers and dedicated IT staff.

Integration-Friendly: Seamlessly connect with other cloud-based financial tools and third-party services.

If your institution values flexible deployment, cost efficiency, and streamlined operations, a cloud-native LOS is generally a better choice than a traditional on-premise solution.

.svg)