Written by

Share this article

Subscribe to updates

What is a Lending Management System (LMS)?

A Lending Management System (LMS) is an all-encompassing software solution designed to automate, centralize, and optimize the life-cycle of loans in financial institutions, mortgage companies, or lending businesses. LMSs have developed into a standard operating tool for modern lending. LMSs are used to manage increasingly complex regulatory requirements, improve efficiency, and enhance the outcome of customer and business goals.

The association with modern lending has limited applicability. The nature of regulation, speed of transactions, and transparency consumers require today means lenders must have robust, scalable solutions that can be used for everything from origination, servicing, compliance, and reporting. Today’s top LMS platforms offer not only workflow automation but also data analytics, integration capabilities, and enhanced borrower experiences—making them the backbone of competitive lending operations.

Key Features of a Lending Management System

End-to-End Loan Lifecycle Automation

A defining feature of leading LMS platforms is their ability to automate every step in the loan lifecycle. This includes origination (application intake and documentation), approval (credit analysis, underwriting, risk assessment), disbursement (fund release, scheduling), ongoing servicing (payment collection, statements, customer support), and collections (reminders, legal processes).

A typical workflow begins with a borrower’s application, which is digitally captured and assessed using built-in tools and third-party integrations. Automated verification, credit checks, and document management reduce the need for manual intervention. Decisions are communicated rapidly, funds are disbursed through integrated payment systems, and ongoing communications with borrowers are managed through the platform’s self-service portals and alerts.

For example, at Zeitro, we leverage an AI-driven knowledge graph and modular automation to streamline every step of the mortgage process—from borrower acquisition and intelligent pre-qualification to automated document management and compliance. This comprehensive approach differentiates our platform from traditional point solutions by providing an integrated, end-to-end solution for lenders.

Customizable Workflows and Rule Engines

Lending operations in today’s market are dynamic. Loan products and regulatory requirements vary widely from bank to bank and from borrower to borrower. Your LMS is customizable, so lenders can tailor how each step is handled—approval hierarchies, escalation paths, exceptions, and so on—to suit their operations. This flexibility allows you to ensure compliance, handle the task efficiently, and improve the borrower experience, regardless of product or geography.

The business logic lenders have in place can be easily changed or edited when regulations or market conditions change, and new products can easily be added. Rule engines are a great way to automate repetitive tasks, enforce eligibility criteria, and accommodate complex scenarios without the need for programming, which also significantly reduces the risk of errors caused by people.

Comprehensive Borrower and Account Management

A robust LMS centralizes borrower profiles, loan accounts, and all related documentation in a secure, searchable environment. This single source of truth improves operational visibility and streamlines compliance audits. Platforms also offer self-service portals, enabling borrowers to apply, upload documents, track loan status, and communicate directly with loan officers—all from any device.

Comprehensive account management reduces administrative overhead and creates a seamless borrower experience, from onboarding to final repayment.

Multi-Product & Multi-Channel Support

Lenders typically offer a variety of their own products - personal loans, mortgages, business loans, microfinance, etc. The processes and compliance requirements for each of these types of loans are generally unique and extraordinarily burdensome. In best-case scenarios, an LMS that can manage these products in a single solution will break down data silos and limit duplicated work.

Beyond data management, providing an omnichannel experience (web, mobile, API) for borrowers and staff means they can interact with the LMS from anywhere and everywhere. The need to support modern customers and a distributed team experience means being flexible and omnichannel is imperative.

Core Benefits for Lenders and Borrowers

Increased Operational Efficiency & Reduced Manual Effort

The core promise of LMS adoption is increased efficiency. Automation minimizes manual intervention, reduces errors, and accelerates loan processing times. Tasks such as data entry, verification, compliance checks, and reporting are handled automatically, freeing staff to focus on higher-value activities.

Our clients have achieved up to a 250% increase in loan pipeline capacity and have reduced document processing time by over 7 hours per file. Additionally, new loan officers are trained 12x faster on average thanks to our platform’s intuitive design and built-in expert guidance.

Improved Compliance and Security

Compliance and data security are non-negotiable in the lending industry. Leading LMS platforms feature built-in controls for KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR or local privacy regulations. Comprehensive audit trails, role-based permissions, and automated regulatory reporting are standard.

Data is encrypted at rest and in transit, and all actions within the system are tracked for transparency and accountability, making regulatory audits smoother and reducing risk for lenders.

Advanced Reporting and Analytics

LMS platforms aggregate operational and financial data, providing real-time dashboards and customizable reports. These insights help management monitor key performance indicators, identify bottlenecks, forecast demand, and optimize resource allocation.

Analytics tools support data-driven decision-making, risk modeling, and scenario analysis, further strengthening the lender’s strategic position.

Enhanced Risk Assessment & Credit Scoring

Effective risk management is critical to portfolio health. LMS platforms integrate built-in credit scoring models and support connections to third-party data sources, such as credit bureaus and alternative data providers. Automated risk assessments ensure consistent, objective evaluations and help identify potential issues before they escalate.

Automated alerts for delinquency or changes in borrower status enable proactive intervention, protecting both lender and borrower interests.

Technology Foundation & Integration Capabilities

Cloud Deployment and Scalability

The shift to cloud-based LMS solutions enables rapid deployment, scalability, and lower total cost of ownership. SaaS models offer automatic updates, high availability, and secure, compliant environments that grow with your business.

For larger institutions, hybrid or on-premise options ensure that unique regulatory, security, or operational needs can be met. The ability to scale resources on demand is crucial for lenders facing seasonal spikes or rapid growth.

API Integrations with Third-Party Services

Seamless integration with payment processors, accounting platforms, credit bureaus, e-signature providers, and other third-party tools is essential. Modern LMS platforms provide robust API frameworks, supporting efficient data exchange and workflow automation across the lending ecosystem.

This interoperability streamlines operations, enhances customer service, and enables lenders to leverage best-in-class services without duplicating effort or risking data integrity.

Mobile Support and Self-Service Applications

A mobile-first approach is standard for leading LMS platforms. Borrowers and staff can access applications, upload documents, and check statuses from any device, improving engagement and reducing delays.

Self-service portals empower borrowers to manage their own loan journeys, reducing inbound support requests and improving satisfaction.

Industry Trends and Future Directions

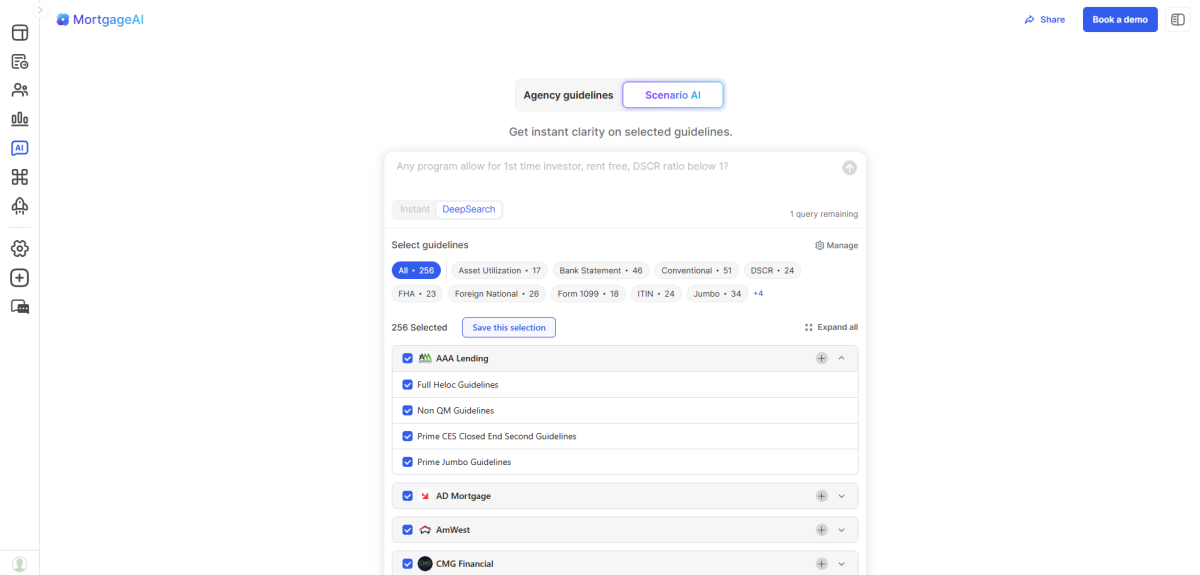

AI and Automation in Lending Management

Artificial intelligence (AI) and automation are transforming the lending landscape. Applications include AI-powered underwriting, fraud detection, predictive analytics, chatbots for borrower support, and intelligent workflow management.

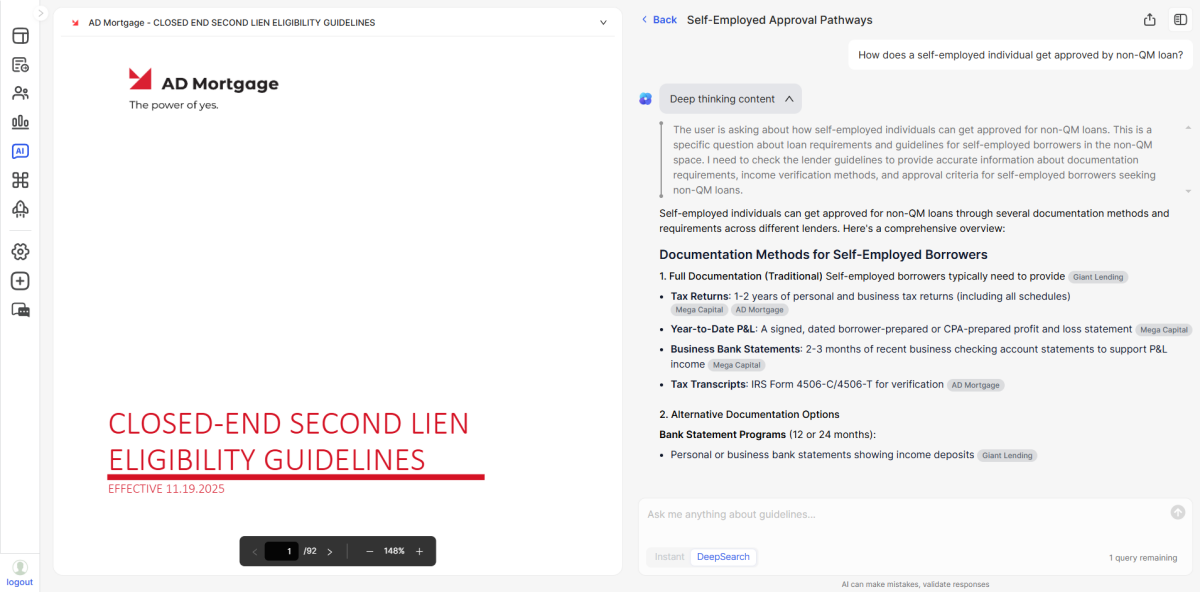

At Zeitro, we are pioneering the integration of advanced AI—such as our GuidelineGPT, which provides 24/7, instant expert guidance on complex underwriting requirements—demonstrating how intelligent automation is transforming compliance, risk management, and overall operational agility.

AI’s ability to analyze vast datasets, recognize patterns, and optimize decisions in real time is raising the bar for efficiency, accuracy, and compliance across the industry.

Modular and Low-Code/No-Code Customization

Lenders seek agility to respond quickly to new regulations, products, or market shifts. Modular LMS architectures and low-code/no-code customization tools empower business users to build or adapt workflows, forms, and decision logic with minimal IT involvement.

This flexibility accelerates innovation, reduces dependency on developers, and keeps lenders ahead of changing market conditions.

Focus on Customer Experience

Borrower expectations are higher than ever. LMS platforms that deliver self-service capabilities, instant approvals, transparent communication, and proactive status updates are key differentiators in a crowded market.

A streamlined, intuitive experience increases application completion rates, fosters trust, and builds lasting borrower relationships.

Frequently Asked Questions (FAQ)

What is the difference between LOS and LMS?

A Loan Origination System (LOS) is designed specifically to manage the initial steps of the lending process, such as application intake, underwriting, and loan approval. A Lending Management System (LMS), by contrast, encompasses the entire loan lifecycle—from origination to servicing, repayment, compliance, and analytics. While every LOS can be part of an LMS, not every LMS focuses solely on origination; instead, it offers broader operational and reporting functionality.

What types of businesses use a Lending Management System?

LMS platforms are used by a wide range of organizations in the financial sector, including banks, credit unions, mortgage lenders, microfinance institutions, peer-to-peer lending platforms, and specialized consumer or business lenders. Any organization seeking to manage large volumes of loans efficiently, maintain compliance, and deliver a streamlined borrower experience can benefit from implementing an LMS.

How is data security ensured in LMS?

Data security in LMS is maintained through multiple layers of protection: encryption (both at rest and in transit), role-based access controls, multi-factor authentication, and continuous monitoring for suspicious activity. Leading platforms are regularly audited for compliance with standards such as SOC 2 or ISO 27001. They also maintain comprehensive audit logs and support privacy regulations (e.g., GDPR, CCPA) to ensure the protection of sensitive borrower data.

How does LMS support compliance with regulations?

LMS platforms automate compliance through built-in rule engines, regulatory reporting modules, and workflow controls that enforce internal and external policies. They support KYC/AML requirements, generate audit trails, and are updated regularly to reflect changing regulations. Automated alerts and reports help ensure that all activities are traceable and that institutions remain audit-ready at all times.

.svg)