Written by

Share this article

Subscribe to updates

As a loan officer who navigates the non-QM market daily, I hear the same frustration from real estate investors constantly. You go to a forum like Reddit, and the thread is filled with horror stories: a lender promised a 6.5% rate, dragged the process out for 45 days, and then killed the deal—or worse, changed the terms—three days before closing.

Finding the "best" DSCR (Debt Service Coverage Ratio) lender in 2026 isn't just about scanning a rate sheet for the lowest number. It is about certainty of execution. In this high-rate environment, a cheap rate is useless if the lender can't fund. Based on current guidelines, closing speeds, and underwriting consistency, I have analyzed the top players in the market to help you avoid the "bait and switch" to get a DSCR loan.

People Also Read:

- Full Guide: What is a non-QM Loan? Everything to Learn

- 8 Best Non-QM Mortgage Lenders in 2026: Which to Choose?

- 2026 Guide: How to Get NMLS License? All the Details

- Best Mortgage Companies for New Loan Officers in 2026

- DSCR Loan Requirements (2026): Ratio, Credit Score, and More

Who is the Number One DSCR Lender?

If any loan officer tells you there is a single "Number One" lender for everyone, run the other way. That's not how the secondary mortgage market works. Every lender has a specific "buy box" (risk appetite). A lender that is aggressive on Airbnb properties might have terrible pricing for a standard long-term rental.

Instead of a ranking, here is a quick "Cheat Sheet" based on where these lenders are winning right now in 2026:

- Best for "No Income/No Ratio" (CDFI): Change Wholesale

- Best for Short-Term Rentals (Airbnb/VRBO): Visio Lending

- Best for Fix-and-Flip Transition: RCN Capital

- Best for Speed & Technology: Kiavi

- Best for Complex Credit Profiles: Angel Oak Mortgage Solutions

- Best for Customer Service & Exceptions: Lendsure

6 Best DSCR Lenders to Consider In 2026

The following list isn't just based on marketing brochures. It is based on track records, funding reliability, and how they handle the underwriting process when things get complicated.

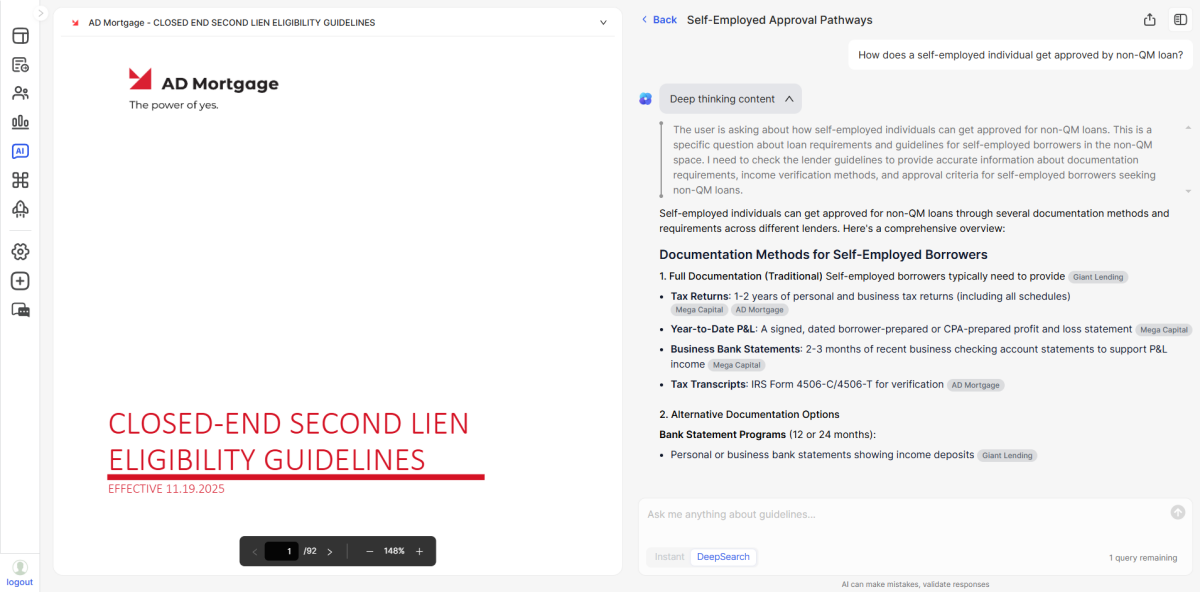

1. Change Wholesale

Change Wholesale is arguably the most unique lender on this list because of their status as a CDFI (Community Development Financial Institution). While most lenders are fighting over DSCR ratios, Change operates with a different playbook. CDFIs like Change Wholesale (part of Change Lending, a certified CDFI) are exempt from CFPB's Ability-to-Repay/Qualified Mortgage (ATR/QM) rule (12 CFR § 1026.43), allowing lighter documentation for certain loans, though they still assess repayment ability under CDFI principles.

This makes them a powerhouse for investors who might have plenty of cash flow but messy paperwork that would scare off a traditional bank. Note that as a wholesale lender, you generally need to access them through an approved mortgage broker.

Highlights:

- Product Type: Community Investor & DSCR.

- LTV: Up to 80% on purchases (depending on FICO).

- Loan Amounts: Can handle Jumbo loans up to $3M+.

- Documentation: Extremely light doc requirements due to CDFI status.

Pros & Cons:

- Pros: They can close loans that literally no one else can touch due to regulatory exemptions. Excellent for investors focusing on underserved markets.

- Cons: Their customer service can be "volume-based" (slower response times during peak periods). You cannot apply directly. You need a broker.

2. RCN Capital

If you have been in the investing game for a while, you know RCN Capital. They are a nationwide direct private lender that has successfully bridged the gap between "Hard Money" and long-term rental loans. In 2026, they remain a top choice for investors who are finishing a rehab project and want to seamlessly refinance into a 30-year fixed DSCR loan without changing lenders.

They are reliable, heavily capitalized, and their guidelines are very clear—they rarely issue a denial at the last minute if the file was set up correctly.

Highlights:

- Term: 30-Year Fixed, ARM, and Interest-Only options.

- Property Types: 1-4 Units, Condos, and Townhomes.

- Min FICO: Generally looking for 620+.

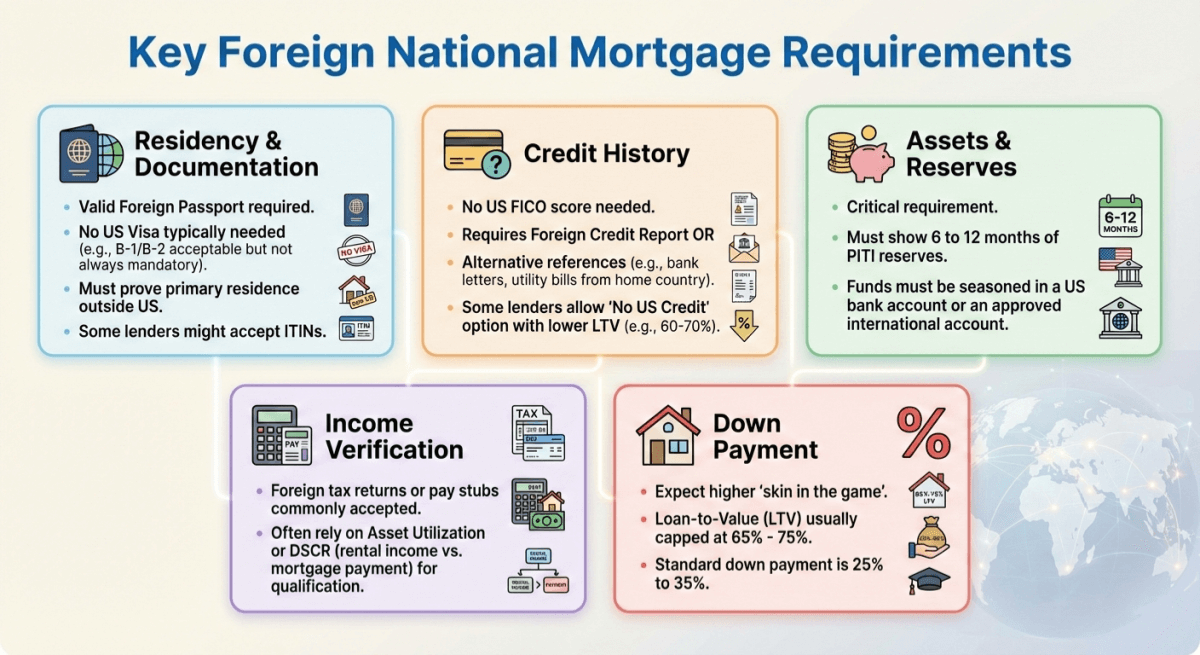

- Foreign Nationals: Allowed (with specific LTV restrictions).

Pros & Cons:

- Pros: They are a direct lender (balance sheet lender), meaning they have full control over their funds. Great reputation for "Flip-to-Rent" scenarios.

- Cons: They are strict on property condition. If your rental is in disrepair, you might need a bridge loan first.

3. Kiavi

Kiavi (formerly LendingHome) is the fintech answer to mortgage lending. If you hate phone calls and prefer uploading documents to a slick online portal, Kiavi is your best bet. They use algorithmic underwriting to speed up the process.

For experienced investors with standard single-family homes, Kiavi is incredibly fast. They rely heavily on data, often using internal valuation models that can be quicker and sometimes more generous than traditional appraisals in specific markets.

Highlights:

- Speed: Closing timeline can be as short as 10-15 days.

- Leverage: Competitive LTVs for experienced investors.

- Process: 100% Online dashboard tracking.

- Appraisals: Often utilize advanced data analytics to streamline valuation.

Pros & Cons:

- Pros: User experience is unmatched. Low fees compared to traditional hard money lenders.

- Cons: They are very "in the box." If your deal has hair on it (complex ownership structure, unique rural property), their algorithm might just say "No."

4. Angel Oak Mortgage Solutions

Angel Oak is effectively the grandfather of the modern Non-QM market. When everyone else pulled out of the market during past volatilities, Angel Oak kept lending. They specialize in the "story" behind the borrower. If you had a foreclosure four years ago or a bankruptcy that is just settled, Angel Oak has a manual underwriting team that actually reads the explanation letters rather than just looking at a credit score.

Highlights:

- Credit Tolerance: Angel Oak's DSCR (Investor Cash Flow) programs typically require minimum FICO scores of 700 for most cases (lower middle score), with higher thresholds like 700+ for LTV ≤80%. Lower scores may apply in select non-DSCR Non-QM programs, not standard DSCR.

- Loan Limits: High balance options available for luxury rentals.

- Vesting: Full LLC and Corporation vesting allowed.

- Experience: One of the largest Non-QM securitization issuers in the US.

Pros & Cons:

- Pros: Deep expertise. If a deal is complex, their account executives know how to structure it to make it work.

- Cons: Because they are a large institution, their turn times (underwriting speed) can sometimes lag behind smaller, nimbler shops.

5. Visio Lending

Visio Lending positions itself specifically as a landlord-focused lender. They were one of the first to aggressively market the DSCR program specifically for Short-Term Rentals (STRs). While many banks struggle to calculate income for an Airbnb property (often wrongly using long-term rental estimates), Visio understands how to use AirDNA data or actual 12-month remittance history to justify the income.

Highlights:

- STR Focus: Specialized underwriting for vacation rentals.

- No DTI: They do not look at personal debt-to-income ratio.

- Doc Prep: streamlined closing process for entities (LLCs).

- Cash-Out: Aggressive cash-out options for portfolio expansion.

Pros & Cons:

- Pros: They understand the vacation rental market better than most.

- Cons: Their fee structure can sometimes be higher (points/fees) compared to a generic bank, but you pay for the specialized underwriting.

6. Lendsure

Lendsure is famous for one thing: Pre-flighting. Before you spend $600 on an appraisal, Lendsure's underwriters will review your scenario to give you a thumbs up or down. This saves investors thousands of dollars in wasted fees. They also have a very strong "exception" policy.

If your DSCR ratio is 0.9 (meaning the rent doesn't quite cover the mortgage) but you have a 780 FICO score and huge cash reserves, Lendsure is the type of lender that might make an exception and fund the deal anyway.

Highlights:

- DSCR Ratio: LendSure's standard DSCR minimum is >1.0 for 1-4 units (calculated as gross rents / PITIA). Ratios under 1.0 indicate insufficient cash flow to cover debt service, though exceptions may exist for strong profiles like high FICO/reserves, often at higher rates. "No Ratio" likely refers to alternative quals, not sub-1.0 standard.

- Property Types: Experienced in Condotels and non-warrantable condos.

- Customer Service: High-touch, dedicated account executives.

- Terms: 40-Year Interest Only options (to help cash flow).

Pros & Cons:

- Pros: Great for "edge cases" where you barely miss the guidelines of other lenders. Excellent communication.

- Cons: Interest rates for their "exception" programs will naturally be higher than standard DSCR loans.

How to Choose a Top DSCR Loan Lender?

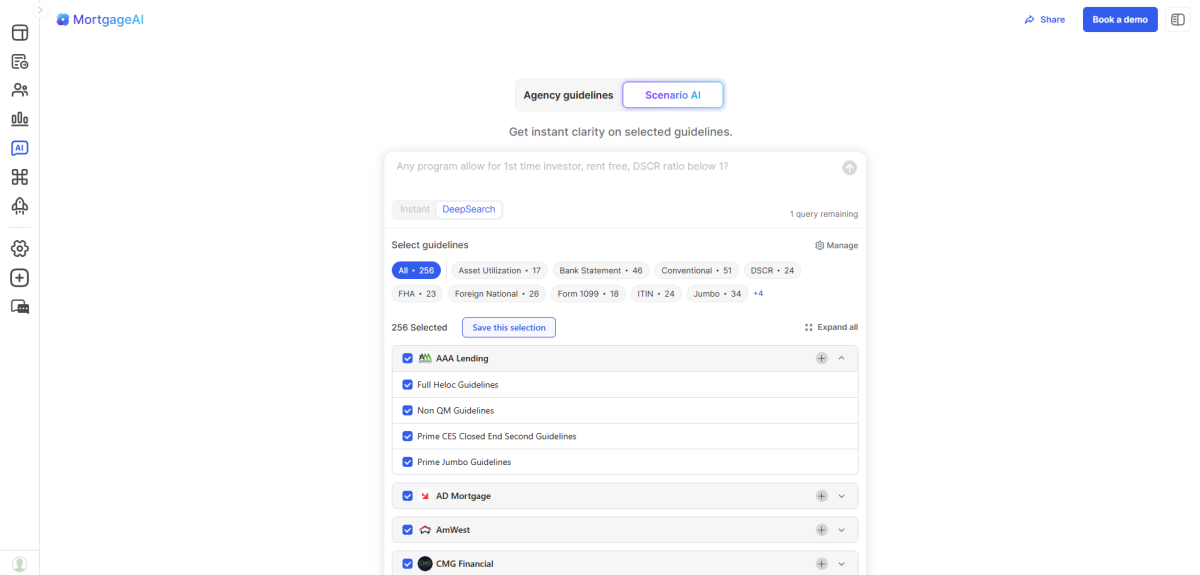

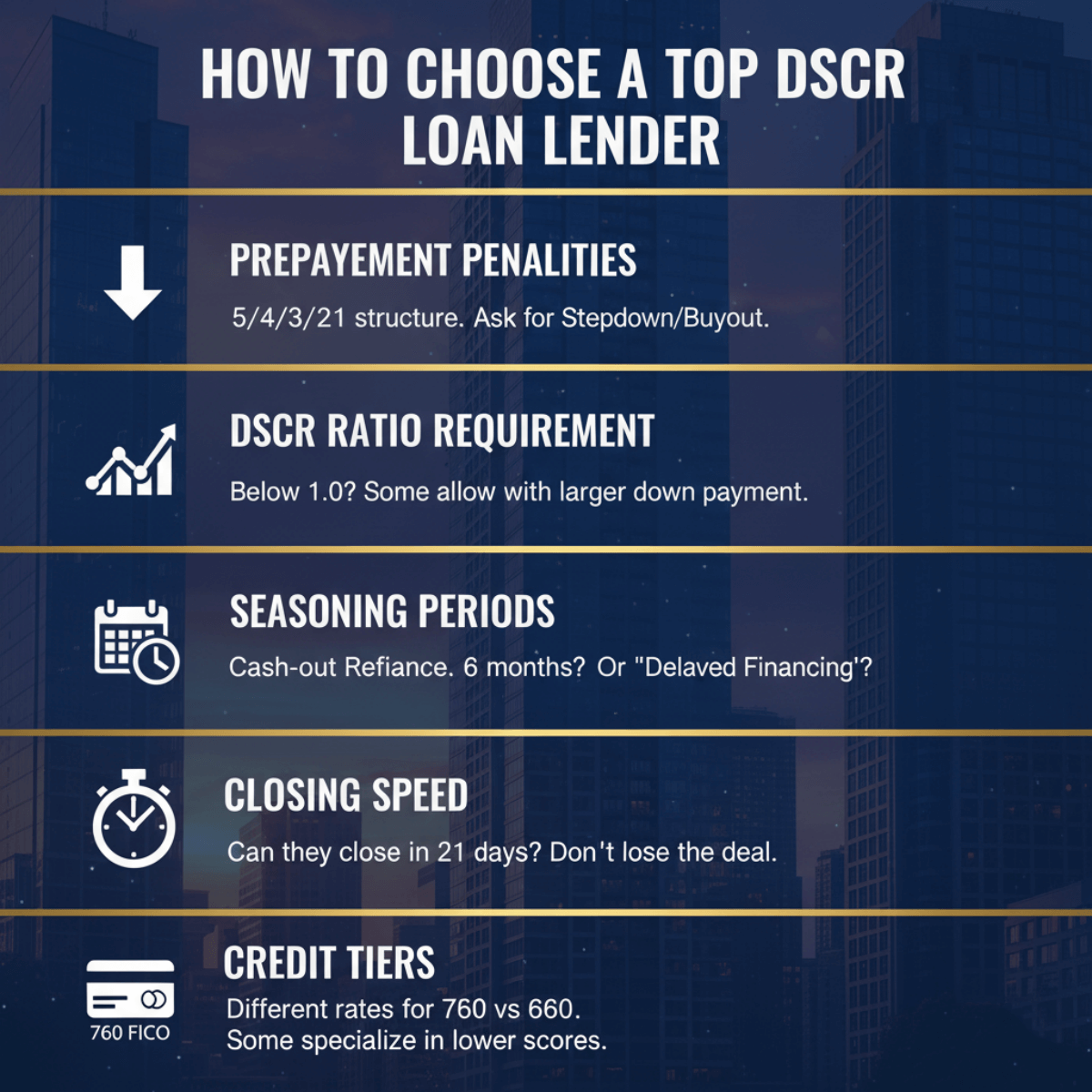

Choosing the best DSCR lender is not like shopping for a pair of shoes. It's about matching your financial profile to the lender's guidelines. When I compare lenders on a pricing engine like Loansifter, here are the critical factors I look at beyond just the interest rate:

- Prepayment Penalties (PPP): This is the "gotcha" clause. Most DSCR loans come with a "5/4/3/2/1" penalty structure (5% penalty if sold in year 1, 4% in year 2, etc.). Ask if the lender offers a "Stepdown" or a buyout option. A lower rate often means a harsher penalty.

- DSCR Ratio Requirement: Can the lender handle a ratio below 1.0? If your rent is $2,000 but the mortgage is $2,200, lenders like Lendsure or Change might still do the deal with a larger down payment, whereas others will instant-deny.

- Seasoning Periods: If you just bought a house cash and want to do a "Cash-Out Refinance," how long do you have to wait? Some lenders require 6 months on title (Seasoning). Others, like RCN or Kiavi, might allow "Delayed Financing" immediately.

- Closing Speed: In a competitive market, can they close in 21 days? If you are buying a property off the MLS, a slow lender will cost you the deal.

- Credit Tiers: Understand that a 760 FICO score gets a wildly different rate than a 660 FICO. If your score is lower, focus on lenders like Angel Oak who specialize in that tier, rather than wasting time with a strict fintech lender.

Final Word

In 2026, the "best" lender is the one that actually gets you to the closing table. As an investor, you should stop viewing the interest rate as the only metric. In the DSCR world, Cash Flow is King, but Liquidity is Queen.

My advice? Don't try to navigate this alone. Many of the wholesale lenders mentioned above offer their best pricing exclusively through mortgage brokers. Find a loan officer who has access to multiple outlets, someone who can run your scenario through RCN, Angel Oak, and Change simultaneously to see who offers the best combination of leverage and rate.

.svg)