Written by

Share this article

Subscribe to updates

I still remember the frustration sitting across from my loan officer a few years ago. I had the cash flow, I had the savings, but because I wrote off significant business expenses on my tax returns, the conventional bank simply said, "No".

It's a scenario that happens way too often. As we head into 2026, the gig economy and self-employment are booming, yet traditional lending guidelines haven't fully caught up. That's where Non-QM (Non-Qualified Mortgage) comes in. These aren't the "subprime" loans of the past. They are smart solutions for borrowers with unique financial DNA. If you're self-employed, an investor, or recovering from a credit event, this guide is my personal take on the best non-QM lenders who can actually say "Yes" to your situation.

8 Top Non-QM Mortgage Lenders

Navigating the mortgage landscape in 2026 requires knowing who specializes in what. I've learned the hard way that not all Non-QM lenders are created equal. Some are fantastic for real estate investors using rental income to qualify, while others are better suited for someone needing a "second chance" after a bankruptcy.

Below, I've curated a list of the top 8 players. I've looked at them through the lens of product variety, customer service, and their willingness to perform manual underwriting. These aren't just faceless banks. They are the institutions bridging the gap for modern borrowers.

#1 New American Funding

Best For: Manual Underwriting & Self-Employed Flexibility

When I dig into New American Funding, what stands out is their philosophy that a borrower is more than just a FICO score. They are one of the few large lenders that have truly mastered the art of "manual underwriting". This means a human being, not just an algorithm, reviews your file.

Their proprietary "Non-QM" suite (often referred to as their "SmartSelf" or similar portfolio products) is designed specifically for entrepreneurs. If you are a business owner who minimizes net income for tax purposes, New American Funding allows you to use bank statements to prove your real cash flow.

Pros:

- The "I CAN" Mortgage: They are willing to look at the whole picture, making them ideal for borrowers with complex income streams.

- Latino Focus: They are a leader in serving Hispanic communities with bilingual support and culturally competent underwriting.

- Flexibility: They often accept lower credit scores if other compensating factors (like a large down payment) are present.

Cons:

- Rates: Like most Non-QM options, expect rates to be higher than a standard Fannie Mae loan.

- Fees: Be sure to check their origination fees, as manual underwriting is labor-intensive and can cost more.

#2 Carrington Mortgage Services

Best For: Credit Challenges & Second Chances

If your credit report looks a bit bruised, perhaps due to a past foreclosure or bankruptcy, Carrington Mortgage Services is likely your best ally. In my research, Carrington consistently positions itself as the lender for the "underserved" market. They don't shy away from borrowers with credit scores that would make other banks run for the hills.

Carrington is particularly strong if your FICO score is in the 500s. While most lenders in 2026 cap their risk at 620 or 640, Carrington has programs that can go down to 500-550, provided you have "skin in the game" (a decent down payment). They understand that life events happen.

Pros:

- Accessibility: One of the most forgiving underwriting departments in the industry.

- Recent Events: They can often approve loans sooner after a negative credit event (like Chapter 13 bankruptcy) than traditional guidelines allow.

- FHA Expertise: Alongside Non-QM, they are experts in manual FHA underwriting.

Cons:

- Cost: You pay for the risk. Expect significantly higher interest rates and potentially higher closing costs compared to prime lenders.

- Scrutiny: Because they take on high risk, they will scrutinize your ability to repay very strictly.

#3 Angel Oak Mortgage Solutions

Best For: The "Gold Standard" of Non-QM Variety

In the mortgage broker world, Angel Oak is practically synonymous with Non-QM. They were one of the first to rebuild this market after the 2008 crash, doing it responsibly. I view them as the "specialist" in the room. While big banks dabble in Non-QM, Angel Oak lives and breathes it.

Their standout product is the Bank Statement Loan for self-employed borrowers, allowing you to qualify using 12 or 24 months of personal or business bank statements, no tax returns required. They also dominate the "Investor Cash Flow" space, where qualification is based solely on the property's rental income (DSCR).

Pros:

- Speed: Since they specialize in this, their underwriters understand complex files faster than a generalist bank would.

- Loan Limits: They offer "Non-QM Jumbo" loans, allowing you to borrow amounts far exceeding standard county limits (often up to $3M).

- Stability: As a veteran in the space, they are less likely to pull funding at the last minute.

Cons:

- Wholesale Focus: They primarily work through mortgage brokers. You often cannot walk into a retail branch. you need a loan officer who is partnered with them.

- Strict Guidelines: Because they securitize their loans, they stick rigidly to their own rules.

#4 Rate.com

Best For: Technology & Digital Experience

If you are like me and prefer uploading documents to a secure portal rather than faxing or mailing paperwork, Rate.com (formerly Guaranteed Rate) is a breath of fresh air. In 2026, their digital mortgage platform remains one of the best in the industry.

While they are massive in the conventional space, they have aggressively expanded their Non-QM offerings. Their "FlashClose" technology helps speed up the signing process, which is rare for Non-QM loans that usually drown you in paper. They offer solid 1099-only programs for gig workers and freelancers who might not have traditional paystubs.

Pros:

- User Experience: The interface is intuitive, transparent, and fast. You can track your loan status in real-time.

- Variety: Because they are a huge retail lender, they have access to multiple capital sources, offering a wide menu of products.

- Convenience: Great for tech-savvy borrowers who want a streamlined process.

Cons:

- The "Big Box" Feel: If your file is extremely messy, you might get lost in the shuffle compared to a boutique lender.

- Overlays: They might have slightly higher credit score requirements than a specialist like Carrington to fit their automated models.

#5 Northpointe Bank

Best For: Portfolio Lending & Medical Professionals

Northpointe Bank operates differently than many others on this list because they are a strong "portfolio lender". This means they often keep the loans they originate on their own books rather than selling them to investors immediately. This gives them the power to make common-sense exceptions.

I've found them to be an excellent choice for high-net-worth individuals and medical professionals. They have specific programs that allow doctors or residents to exclude student loan debt from their debt-to-income (DTI) calculations. Furthermore, if you have complex assets but low taxable income, Northpointe is creative in how they calculate your buying power.

Pros:

- Customization: They can tailor a loan to fit a borrower's specific financial picture better than a lender bound by secondary market rules.

- High LTV: They have been known to offer higher Loan-to-Value ratios for qualified professionals (meaning lower down payments).

- Rates: For high-credit borrowers, their Non-QM rates are often very competitive.

Cons:

- Geography: They lend nationally, but specific program availability can vary by state.

- Credit Standards: They generally prefer borrowers with good credit (680+) who just happen to have unique income, rather than "bad credit" borrowers.

#6 Change Wholesale

Best For: No Income Documentation (CDFI)

Change Wholesale (part of The Change Company) is a unique beast in the mortgage jungle. They are a CDFI (Community Development Financial Institution). This certification from the U.S. Treasury allows them regulatory exemptions that standard banks don't get, specifically to serve underbanked communities.

Their flagship "Community Mortgage" often requires zero income documentation, no tax returns, no P&L, sometimes not even employment verification, provided the borrower has a strong down payment and decent credit. It is as close to the old-school "No Doc" loans as you can legally get in 2026, focusing on equity rather than income.

Pros:

- Ease of Qualification: If you fit their target demographic or geographic area, the paperwork is incredibly minimal.

- Social Mission: They focus on Black, Latino, and low-income borrowers who have been historically shut out.

- True No-Ratio: Qualification is often based primarily on the collateral and credit history.

Cons:

- Broker Required: As the name implies, they are "Wholesale". You must find a mortgage broker to access their products.

- Niche: You have to ensure the property or borrower fits their specific CDFI criteria.

#7 Guild Mortgage

Best For: Relationship & Long-Term Servicing

Guild Mortgage feels less like a transactional bank and more like a partner. They have been around for decades and have built a reputation for retaining the "servicing" of their loans. This means when you make your monthly payment, you're likely still paying Guild, not some random third-party company you've never heard of.

For Non-QM, Guild offers flexible programs for self-employed borrowers and those with significant assets. I appreciate their "Complete Rate" approach, which tries to verify income upfront to give you a solid pre-approval rather than a flimsy pre-qualification.

Pros:

- Customer Service: They consistently rank high in customer satisfaction studies (like J.D. Power).

- Local Presence: They have many physical branches, which is great if you prefer sitting down with someone face-to-face.

- Reliability: A very stable lender that doesn't tend to change guidelines mid-process.

Cons:

- Tech: While functional, their digital tools might feel a step behind Rate.com.

- Conservative: They may be less adventurous with credit scores than Carrington or Angel Oak.

#8 AD Mortgage

Best For: Real Estate Investors & Foreign Nationals

If you are looking to build a rental portfolio in 2026, AD Mortgage should be on your radar. They have aggressively targeted the DSCR (Debt Service Coverage Ratio) market. This means they qualify the loan based on the cash flow of the property (Rent vs. Mortgage Payment) rather than your personal income.

They are also a top choice for Foreign Nationals (non-US citizens) looking to buy US real estate. What interests me about AD Mortgage is their innovation. in recent years, they have been open to using cryptocurrency holdings for reserve requirements, which is a game-changer for modern investors.

Pros:

- Investor Friendly: Fast closings for investment properties with minimal personal document requirements.

- Innovation: Willing to accept crypto assets for reserves and utilize 1099 income creatively.

- Loan Limits: High loan amounts available for luxury investment properties.

Cons:

- Volatility: Their rates and guidelines can shift quickly with market conditions.

- Broker Dependent: Like Angel Oak, they do a massive amount of business through wholesale channels, so finding a broker who knows their system is key.

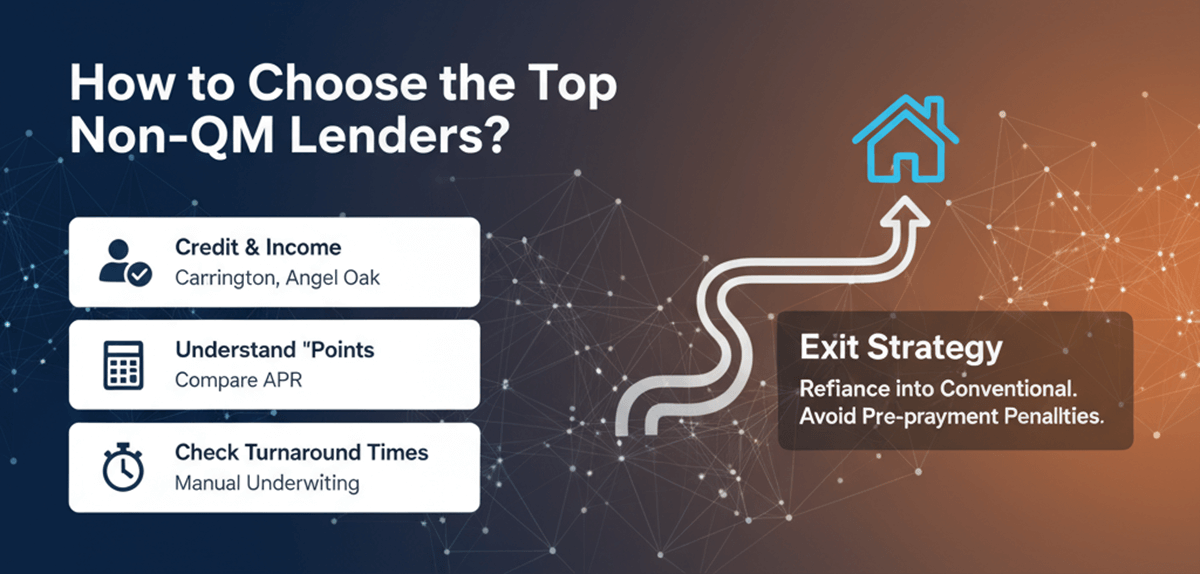

How to Choose the Top Non-QM Lenders?

Choosing the "best" lender isn't about looking for the lowest advertised rate, because in the Non-QM world, rates depend entirely on your specific risk factors. Here is my personal checklist for selecting the right partner:

- Identify Your Primary Hurdle: Are you rejected because of credit (look at Carrington) or income documentation (look at Angel Oak or NAF)?

- Ask About "Points": Non-QM loans often come with "discount points" (upfront fees to lower the rate). Make sure you compare the APR, not just the interest rate, to see the true cost.

- Check Turnaround Times: Non-QM loans are manually underwritten and take longer. If you have a strict 30-day closing deadline, ask the lender explicitly if they can meet it.

- Exit Strategy: Remember, Non-QM is often a temporary solution. Ask the lender about "Pre-payment Penalties". You want the flexibility to refinance into a cheaper conventional loan once your financial situation improves.

FAQs About Best Non-QM Lenders

Q1. What credit score do you need for a non-QM loan?

There is no single answer, but generally, the floor is lower than conventional loans. While most lenders prefer a score of 620 to 680, specialists like Carrington Mortgage Services can go as low as 500 to 580. However, keep in mind: the lower your score, the larger the down payment required (often 20-30%) and the higher your interest rate will be.

Q2. Where to find the best non-QM mortgage lenders near me?

This is where things have changed in 2026. In the past, I would have told you to call random brokers from Google Maps. But the problem is, many local loan officers are "assigned" to you and may not have deep experience with Non-QM products.

I recently discovered Bluerate, and it's a game-changer. Instead of being stuck with whoever picks up the phone, Bluerate allows you to search for local non-QM loan officers who specifically list "Non-QM" or "Self-Employed" as their specialty. You can view their profiles, compare their expertise, and book a free consultation directly. It puts the power back in your hands to choose an expert who actually understands your niche.

Q3. Can you refinance out of a non-QM loan?

Absolutely, and you should plan to! I always advise treating a Non-QM loan as a "bridge". You use it to secure the house now. Then, after 12 to 24 months, when your tax returns show more income or your credit score has healed, you refinance into a Conventional or FHA loan to get a lower rate. Just watch out for those pre-payment penalties I mentioned earlier (usually effective for the first 1-3 years).

Q4. What is the 3-7-3 rule in mortgage?

This is a compliance rule meant to protect you, but it can delay your closing if you aren't careful.

3: You must receive your Loan Estimate within 3 business days of applying.

7: You must wait at least 7 business days after receiving that estimate before you can sign the final closing docs.

3: If the APR on your loan changes by more than 0.125% (which happens often in Non-QM if terms are tweaked), a new 3-day waiting period is triggered before you can close.

Conclusion

The mortgage market in 2026 is diverse, and a "No" from a big bank is not the end of your homeownership journey. Whether you are an entrepreneur utilizing New American Funding, an investor leveraging AD Mortgage, or someone rebuilding credit with Carrington, there is a pathway for you.

My final piece of advice? Don't navigate this alone. The Non-QM landscape is complex and varies by state. Use tools like Bluerate to find a dedicated advocate who can shop these lenders for you. Compare the terms, read the fine print on pre-payment penalties, and choose the lender that sees the value in you, not just your tax return.

People Also Read

- Best CRM for Loan Officers 2026: Which One Suits You Most?

- 6 Top Loan Origination Systems 2026: Close More Loans Quicker

- 8 Best Mortgage Lead Generation Companies in 2026: Don't Miss

- [Tips] Where to Buy Mortgage Leads? Warm Leads for LOs

.svg)