Written by

Share this article

Subscribe to updates

If you are a Loan Officer (LO), a mortgage broker, or running a lending shop in the US, you know the drill: the market is unforgiving. We've moved past the "refi boom" days, where the phone just wouldn't stop ringing. In the current economic climate, with fluctuating interest rates and tight housing inventory, finding high-quality mortgage leads isn't just a "nice to have," it's a survival mechanism.

The problem? Most "leads" today are recycled garbage, cold numbers that have been called ten times before you even get the dial tone. High-quality, exclusive mortgage leads are becoming the unicorn of our industry. In this guide, I'm cutting through the noise to share the top players for 2026, helping you decide whether to build your own pipeline or buy your way in.

4 Services and Software to Build Your Own Leads

If you prefer to own your data and build a sustainable pipeline rather than fighting for shared leads in a "shark tank," these four platforms are where you should start looking.

#1 Bluerate

Let's start with a platform that is genuinely shifting the paradigm in 2026. Bluerate, developed by the tech innovators at Zeitro, isn't just a lead gen tool; it's a comprehensive Mortgage Marketplace acting as a bridge between Loan Officers and borrowers.

What I love about Bluerate is the barrier to entry, or lack thereof. As a Loan Officer, you can register for free and build a professional profile page. This isn't just a digital business card. You can highlight your specific expertise, whether that's VA loans, FHA, or Jumbo products, along with your state licensing and languages spoken. Currently, over 3,000 LOs are already on the platform.

The magic lies in how you get found. Once your profile is live, Bluerate leverages heavy-hitting SEO optimization to put you in front of borrowers searching organically. You aren't chasing the client. The client finds you while searching for rates or advice. This means the leads are incredibly warm, high-intent, and exclusive to you. Of course, if you want to scale faster, you have the option to run your own Google or Meta ads pointing to this profile, but the organic traffic alone is a massive win.

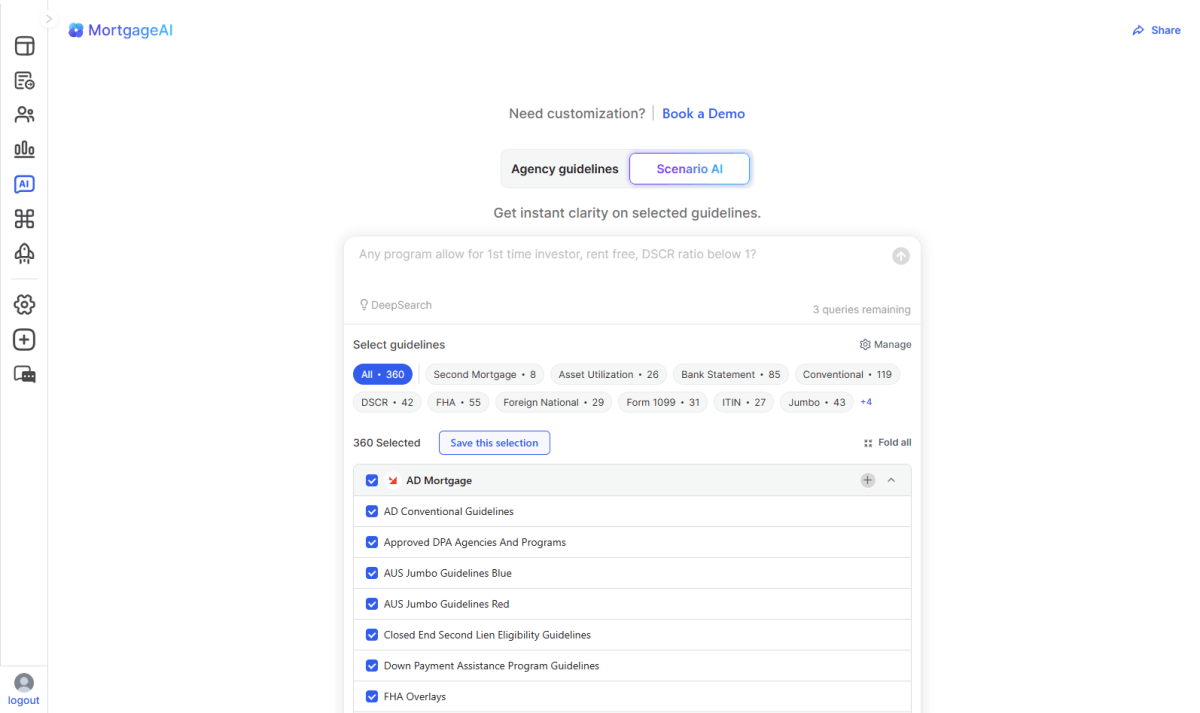

Beyond just leads, Bluerate is an operational beast. It integrates the best Loan Origination System (LOS). I'm talking about total transparency from the initial Rate Quote to the final Close. The AI integration here is legitimate:

GuidelineGPT & Scenario AI: These tools are lifesavers. They reduce manual guideline research by 100%. You can get instant, accurate answers on complex scenarios, saving professionals 7+ hours per loan file.

Streamlined Tech: Borrowers can pre-qualify online, complete the 1003 form easily, and export data in FNM 3.4 format. The system even automates document collection (income statements, tax returns) and calculates DTI instantly.

The result? Data shows a 20% faster loan closing speed and a 30% increase in closed loans. It's an ecosystem, not just a lead seller.

#2 LeadPops

If you are tired of generic landing pages that don't convert, you have probably heard of LeadPops. Founded by Andrew Pawlak, this company focuses heavily on "conversion funnels" rather than just standard websites.

The philosophy here is simple: getting traffic is one thing, but getting that traffic to give you their information is another. LeadPops provides pre-built, high-converting funnels that ask users questions in a way that feels less like a strict application and more like a quiz. This psychological approach tends to increase submission rates significantly.

The advantage of LeadPops is that it plugs into your existing marketing. If you are already running Facebook ads or have a decent social media following, LeadPops ensures you aren't wasting those clicks. However, the downside is that it is primarily a software solution for conversion. You are still largely responsible for driving the traffic to these funnels. If you don't have a marketing budget or organic reach, having a great funnel won't matter much. But for LOs who know how to drive traffic, this tool maximizes ROI.

#3 Kaleidico

Kaleidico sits in a different bracket; they are a full-service digital agency deeply rooted in the mortgage industry. Led by Bill Rice, they don't just sell you a software subscription; they build a custom lead generation engine for your business.

Their approach is content-first. Kaleidico excels at building authoritative websites and filling them with high-quality content that ranks on Google. They focus on the long game, building your "E-E-A-T" (Experience, Expertise, Authoritativeness, and Trustworthiness) so that you attract organic leads over time. They also manage PPC campaigns and email marketing automation.

The pro here is the quality. The leads generated via Kaleidico's strategies are often exclusive and well-educated on the mortgage process. The con? It is an investment. This isn't a "flip a switch" solution for $50 a month. It requires a marketing budget and patience. If you are a larger branch or a brokerage looking to dominate a specific region in the US and outsource your entire marketing department, Kaleidico is a strong contender.

#4 Hova Digital

Hova Digital is a specialist agency that focuses strictly on Google Ads management for Mortgage Loan Officers. Unlike generalist marketing agencies, they understand the specific compliance nuances and keywords necessary for the mortgage industry.

The core of their offering is speed. SEO takes time, but Google Ads (PPC) can generate leads the moment you turn them on. Hova Digital builds the campaigns, manages the bidding strategies, and directs the traffic to landing pages designed to capture borrower info.

The major advantage is predictability. You know exactly how much you are spending and what your cost-per-lead (CPL) is. They claim to help LOs generate exclusive leads on demand. The downside, naturally, is the cost of ad spend. In competitive markets (like California or New York), the cost per click can be high. However, if you have the budget and need leads now, Hova Digital removes the headache of managing complex ad accounts yourself.

4 Marketplaces to Buy Mortgage Leads

If you don't have the time to build funnels or manage campaigns, buying mortgage leads from established marketplaces is an alternative. Here are the giants you will encounter.

#1 LendingTree

You cannot talk about mortgage leads without mentioning LendingTree. They are arguably the most recognized brand by consumers in the US. When a borrower thinks "compare rates," they think LendingTree.

The volume here is unmatched. If you need to fill a call center floor or have a hungry team of junior LOs, LendingTree can provide the quantity you need. They offer various filters to target specific loan types and credit profiles.

However, the "LendingTree effect" is real. These are typically shared leads, meaning the moment you get the data, 3 to 5 other lenders get it too. It becomes a race to the phone and often a race to the bottom on rates. Conversion rates can be lower because the competition is fierce. It works best for lenders with aggressive pricing and ultra-fast speed-to-lead capabilities.

#2 Bankrate

Bankrate is a powerhouse of financial information. Because they produce high-level editorial content, the consumers landing on their site are often financially literate and serious about their mortgage search.

Advertising on Bankrate's rate tables allows you to display your live rates directly to these high-intent borrowers. The leads generated here are often "warmer" than typical form-fill leads because the user has usually seen your rate and clicked specifically on you.

The downside is the cost and competition. Getting into the top spots on Bankrate's tables requires a significant budget and competitive rates. If your rates are not in the top tier, you likely won't see much volume. It is a playground for established lenders rather than individual LOs starting out.

#3 FreeRateUpdate

FreeRateUpdate is a solid option for those looking for real-time mortgage leads without the massive overhead of the bigger brands. They specialize in capturing leads at the moment of interest and scrubbing them for quality before passing them on.

They are known for having a good mix of purchase and refinance leads. One distinct advantage is their verification process; they try to filter out the "junk" leads that plague other marketplaces. They also offer live transfer options in some cases, which connects you immediately to a borrower on the phone.

The feedback on FreeRateUpdate is generally mixed regarding volume, it may not rain leads like LendingTree, but the cost-per-acquisition (CPA) can often be lower. It's a good middle-ground marketplace for independent brokers who want to buy leads without blowing a massive budget.

#4 Zillow

Zillow owns the top of the funnel for home buying. Most people start their journey here looking at houses, not loans. This gives Zillow a unique advantage: they capture the borrower before they have even thought about finding a lender.

Through Zillow Home Loans and their advertising programs for lenders (often connected with Premier Agent), you can get visibility with borrowers who are actively touring homes. These are purchase-focused leads, which are incredibly valuable in a high-rate environment where refis are down.

The catch? It is expensive, and you are playing in a walled garden. You are also often dependent on the real estate agent's relationship. However, the intent is undeniable. If you want purchase leads, Zillow is the biggest game in town, but be prepared to pay a premium for that access.

How to Choose the Best Mortgage Lead Generation Company?

With so many options, making the right choice for 2026 depends on your specific business model. Here is how I break it down:

- Consider your budget: Are you ready to spend thousands on ad spend (Hova/Zillow), or do you need a cost-effective start? If funds are tight, platforms offering free profiles or organic reach are safer.

- Assess your in-house capabilities: Do you have a marketing team? If yes, software like LeadPops is great. If you are a solo operator with no tech skills, you need a "done-for-you" service or a marketplace.

- Determine lead exclusivity: Do you have the speed to call shared leads within 5 seconds? If not, avoid shared marketplaces like LendingTree. Look for platforms that generate exclusive leads directly to you.

- Evaluate company's reputation: Look for verified reviews. Does the company offer support? Do they scrub their data? In 2026, data quality matters more than quantity.

FAQs About Top Mortgage Lead Generation Companies

Q1. Where is the best place to get mortgage leads?

There is no single "best" place, but generally, leads that you generate yourself (organic or PPC) convert higher than shared leads you buy. Platforms that allow you to build your own brand usually yield better long-term ROI.

Q2. What is the best lead generation company?

For individual Loan Officers seeking a balance of technology and lead flow, Bluerate is currently the standout for 2026 due to its comprehensive ecosystem. For large lenders needing volume, LendingTree remains the leader.

Q3. How to generate leads for mortgage loans?

You can generate leads by creating educational content (blogs/videos), running paid ads on Google/Facebook, networking with realtors, or utilizing a mortgage marketplace profile to capture organic search traffic.

Q4. How to attract mortgage clients?

To attract clients naturally, you need visibility. I highly recommend using Bluerate to create a personal profile page. Because they optimize for SEO, your profile can appear in search results when locals search for lenders. These organic leads are usually high-converting because they found you based on your specific expertise, rather than a cold ad.

Conclusion

Navigating the mortgage lead landscape in 2026 comes down to one choice: Services vs. Marketplaces.

Marketplaces like LendingTree or Zillow offer immediate volume but come with high costs and fierce competition. You are renting their audience. On the other hand, Services and Software allow you to own your process, but they often require technical know-how or ad spend.

This is why I personally lean towards Bluerate as the top recommendation for this year. It bridges the gap perfectly. You get the benefits of a marketplace (traffic and visibility) without the "Shark Tank" competition of shared leads. Plus, with the integrated AI tools and LOS, you aren't just getting a lead; you're getting a closed loan. If you want to future-proof your business, start building your presence where the borrowers are actually looking.

People Also Read

- 6 Best Mortgage CRM for Brokers, Lenders, MLOs in 2026

- 6 Best Loan Origination Software for LOs/Brokers in 2026

.svg)

![[2026 Update] 8 Highest-Rated Reverse Mortgage Companies for You](https://cdn.prod.website-files.com/6731bc6e813a541b54c30b10/69a9410f689f89e0ab014f5a_best-reverse-mortgage-companies-banner.png)