Written by

Share this article

Subscribe to updates

I have seen it happen too many times: a financially stable business owner walks into a big bank, ready to buy their dream home, only to be shown the door because their tax returns don't tell the full story. It's frustrating, isn't it? You know you can afford the mortgage, but the traditional "check-the-box" system says otherwise.

This is where a Non-QM loan (Non-Qualified Mortgage) becomes a game-changer. It isn't some shady workaround. It is a legitimate, flexible financing solution designed for the modern economy, gig workers, real estate investors, and self-employed professionals. In fact, data from 2024 shows that Non-QM loans now make up roughly 5% to 8% of the total mortgage market, a number that is steadily rising as more people leave the traditional 9-to-5 workforce.

In this guide, I will walk you through exactly what these loans are, the different types available, and how you can use them to secure a property when traditional banks say "no."

What Is a Non-QM Loan?

To understand a Non-QM loan, I first need to explain what a "QM" is. A Qualified Mortgage (QM) is a standard home loan that meets strict rules set by the federal government, specifically the Consumer Financial Protection Bureau. These rules require lenders to verify your ability to repay using very specific documents, usually W-2s and tax returns, and typically cap your Debt-to-Income (DTI) ratio at 43%.

A Non-QM loan is simply a mortgage that doesn't fit into that rigid box. It uses alternative methods to prove you can pay back the loan.

Let me be clear about one thing: Non-QM is not the "subprime" lending that caused the 2008 housing crash. Back then, people were getting loans with no proof of income or assets. Today, Non-QM lenders are required by law to verify your "Ability to Repay" (ATR). We just do it differently.

Here is a real-world example:Imagine you are a shopkeeper. You made $200,000 in revenue last year, but after deducting your home office, equipment, and travel expenses, your tax return shows a net income of only $40,000. A traditional bank looks at that $40,000 and denies you. A Non-QM lender, however, can look at your bank statements to see the actual cash flow of $200,000 and approve you based on that real liquidity.

Who is this suitable for?In my experience, Non-QM loans are perfect for:

- Self-employed individuals: Business owners, freelancers, and gig workers who write off significant expenses.

- Real Estate Investors: Those who want to qualify based on the property's rental income rather than personal income.

- Foreign Nationals: Buyers who lack a US credit history or Social Security Number.

- High Net Worth Individuals: Retirees or wealthy buyers with low monthly income but massive assets.

- Borrowers with Credit Events: People who have had a bankruptcy or foreclosure recently (often as soon as one day out of foreclosure).

Types of Non-QM Loans

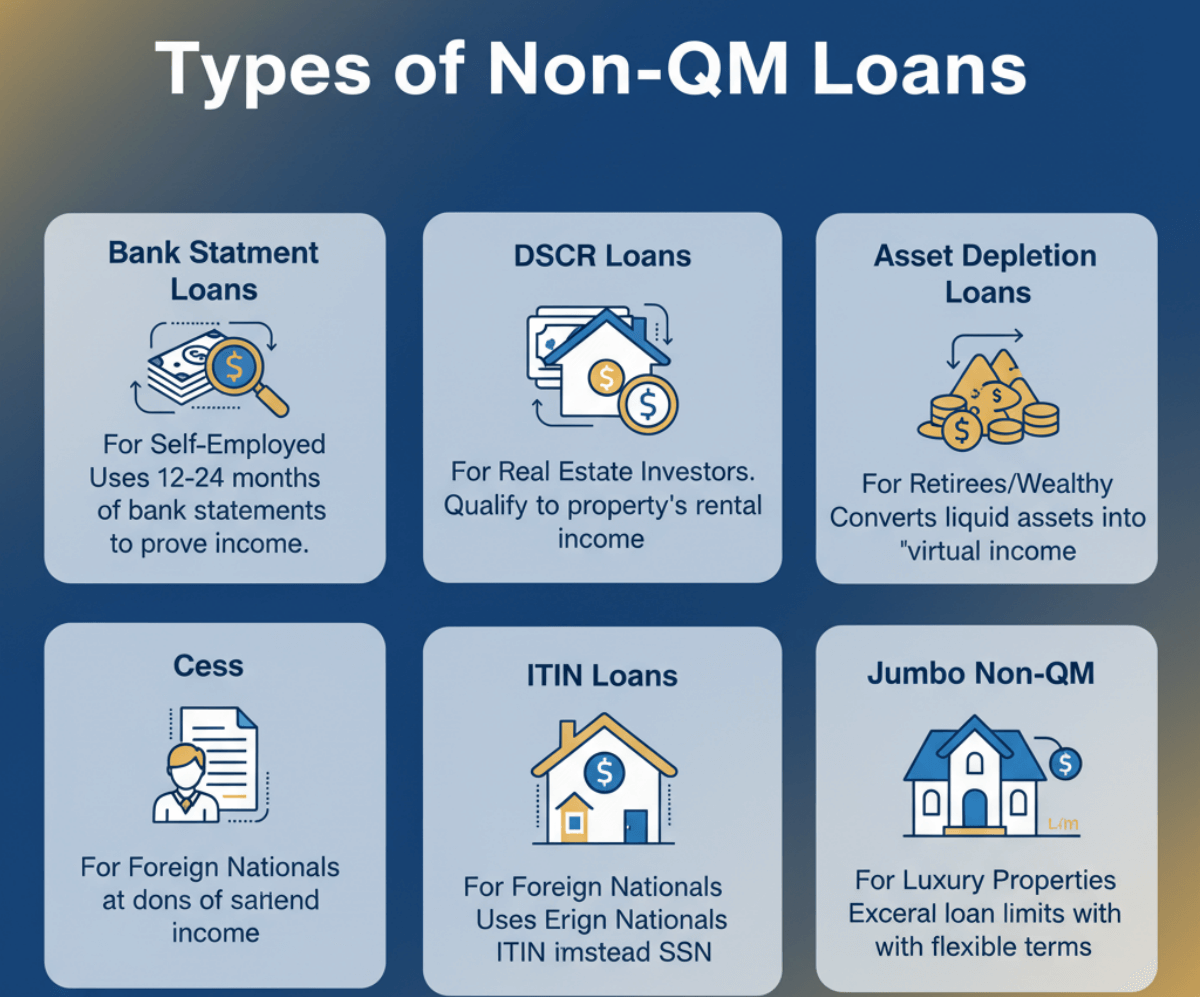

Because "Non-QM" is just a category, not a specific product, it comes in many different flavors. I often tell my clients that there is likely a specific tool for their unique financial situation.

Here are the most common types available in the current market

- Bank Statement Loans: The most popular option for self-employed borrowers. Lenders review 12 to 24 months of personal or business bank statements to calculate your income, ignoring the net income on your tax returns.

- DSCR Loans (Debt Service Coverage Ratio): Designed strictly for real estate investors. We don't check your personal income at all. If the rent the property generates covers the monthly mortgage payment, you qualify.

- Asset Depletion Loans: Ideal for retirees or wealthy individuals. We take your total liquid assets (stocks, savings, retirement) and divide them by a set term (like 84 months) to create a "virtual" monthly income for qualification.

- ITIN Loans: For borrowers living in the US who have an Individual Taxpayer Identification Number (ITIN) but no Social Security Number.

- Jumbo Non-QM: For luxury properties that exceed federal loan limits, offering more flexible terms than traditional Jumbo loans.

Non-QM Loan Requirements

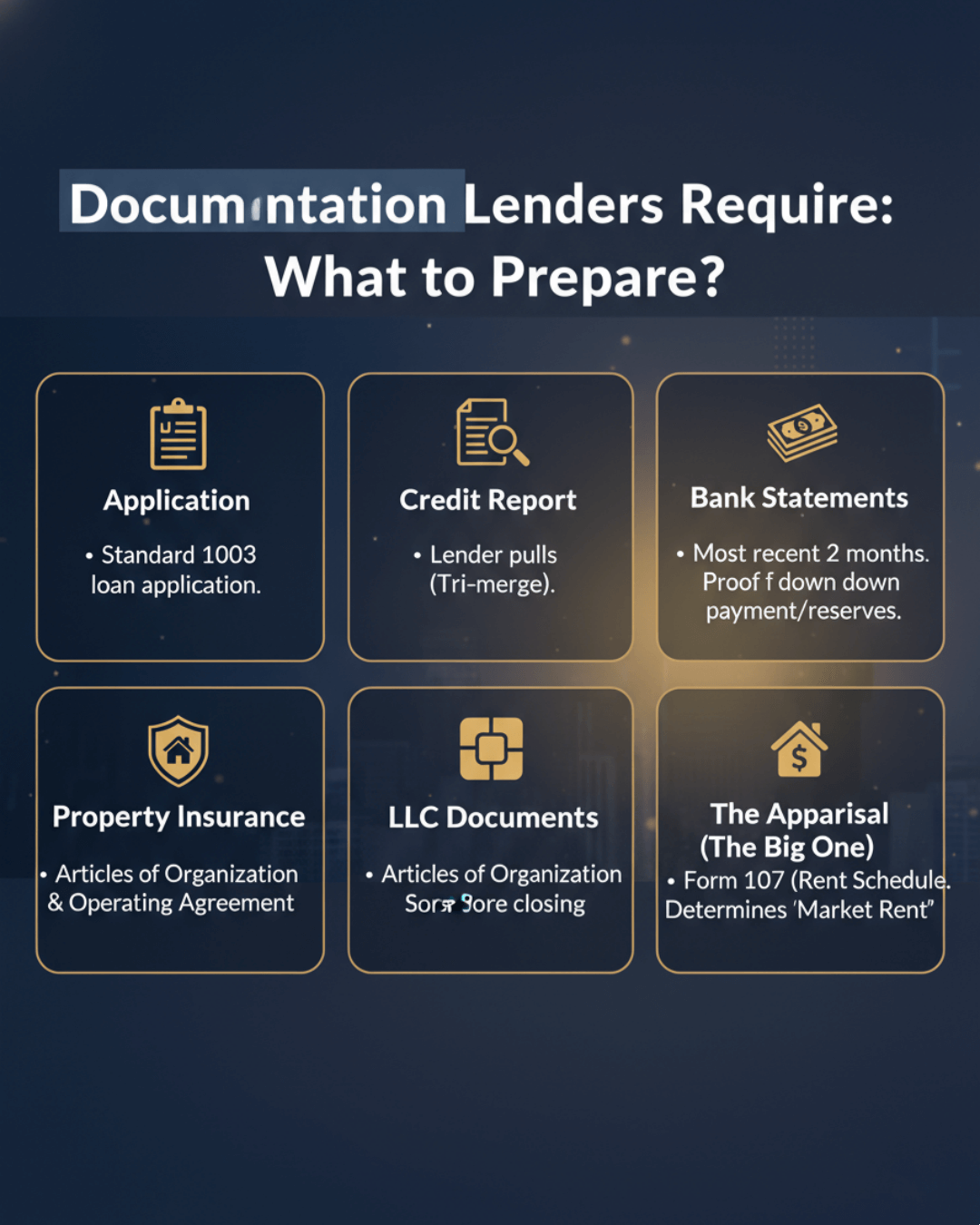

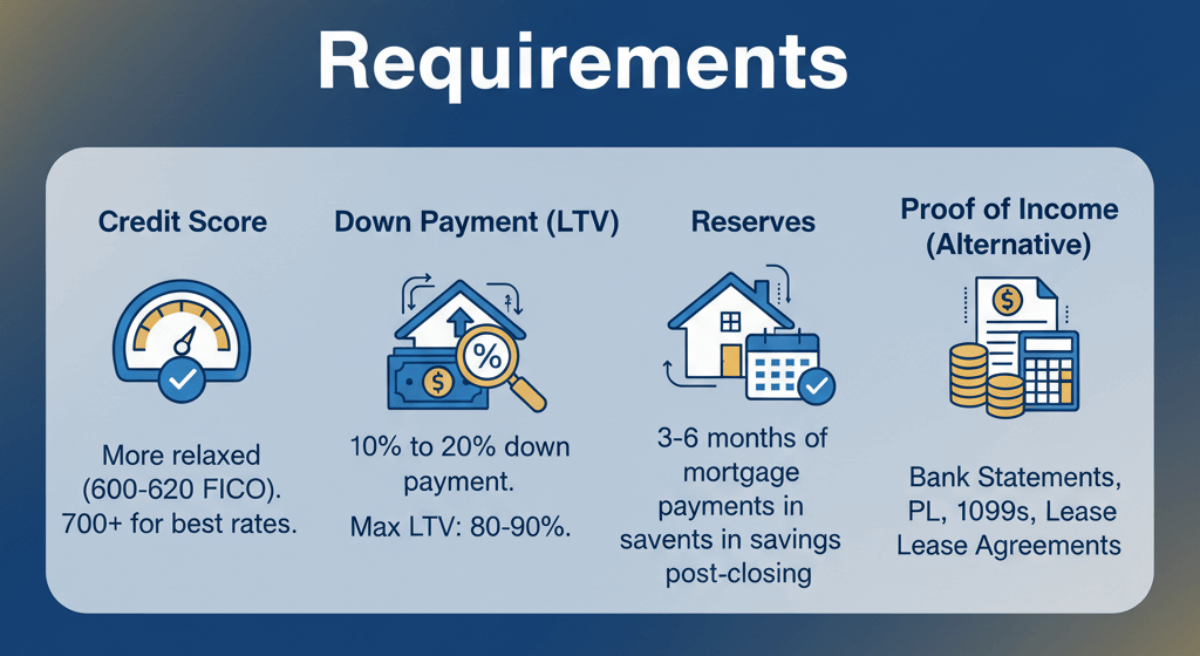

A common misconception I hear is that Non-QM loans are "easy" to get or require no documentation. That is false. These are "Alternative Doc" loans, not "No Doc" loans. Because the lender is taking on more risk by stepping outside the government safety net, they still need assurance that you are a safe bet.

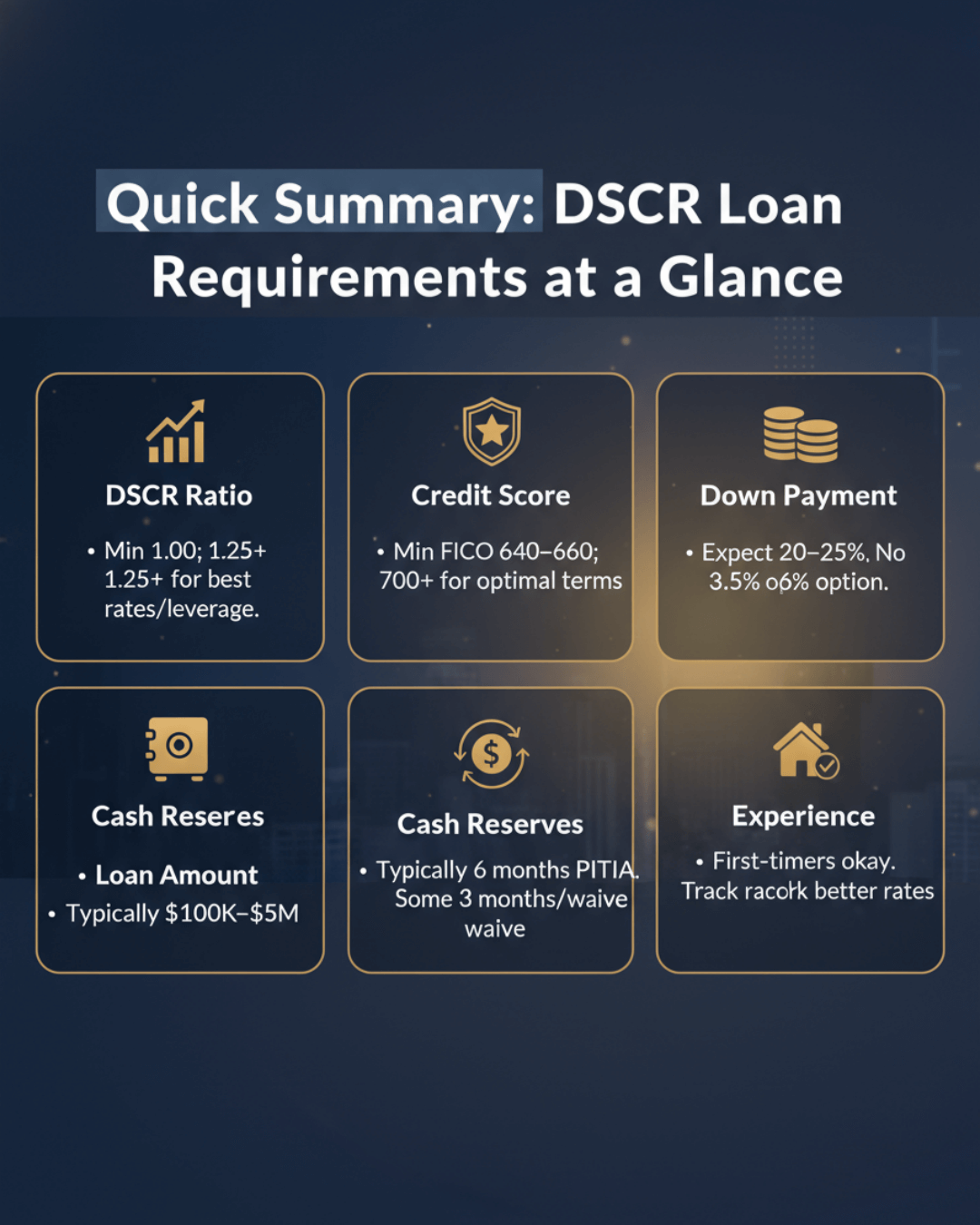

While every lender has different "overlays" (internal rules), here is what you generally need to bring to the table:

- Credit Score: The requirements are more relaxed, but standards still exist. Most lenders look for a FICO score of 600 to 620. However, if you want competitive rates, a score above 700 helps significantly.

- Down Payment (LTV): You usually need more skin in the game. Expect to put down 10% to 20%. The maximum Loan-to-Value (LTV) ratio typically tops out at 80% or 90%.

- Reserves: This is crucial. Lenders often want to see that you have 3 to 6 months of mortgage payments saved up in liquid cash after the closing.

- Proof of Income (Alternative): Depending on the loan type, you must provide bank statements, 1099 forms, P&L statements prepared by a CPA, or lease agreements.

Pros and Cons of Non-QM Loans

I believe in total transparency. Non-QM loans are powerful tools, but they aren't the right fit for everyone. Before you commit, you need to weigh the benefits against the costs.

The Pros:

- High Flexibility: This is the biggest selling point. You aren't held back by tax returns that don't reflect your real cash flow.

- Faster Closing (Especially DSCR): Since we aren't waiting on the IRS to verify tax transcripts or analyzing complex employment histories, investment loans (DSCR) can often close faster than conventional loans.

- Access to Unique Properties: Non-QM lenders are often more willing to finance "non-warrantable" condos (like condotels) that Fannie Mae and Freddie Mac won't touch.

The Cons:

- Higher Interest Rates: Flexibility comes at a price. In the current 2024-2026 market, you can expect Non-QM rates to be roughly 1% to 2% higher than a standard conventional mortgage.

- Larger Down Payment: You typically cannot buy with 3% or 5% down like you can with an FHA or conventional loan.

- Fewer Lenders: You can't just walk into a local branch of a major bank (like Chase or Wells Fargo) for these. You almost always need to work through a specialized Mortgage Broker.

QM vs. Non-QM Mortgages: Key Differences

When clients ask me to compare these two, I break them down into four distinct categories to make it easy to digest.

Underwriting & Documentation

- QM: Extremely standardized. It relies heavily on W-2s, tax returns, and automated underwriting systems. It fits "square peg" borrowers.

- Non-QM: Manual and logical. Human underwriters review bank statements or assets to make a common-sense decision on your ability to pay.

Borrower Protection

- QM: Offers lenders a "Safe Harbor," meaning they are legally protected if you default, provided they followed the rules.

- Non-QM: Does not offer this Safe Harbor. This means the lender takes on higher legal risk, which is why they are very careful about verifying your reserves and credit history.

Credit & LTV Limits

- QM: Strict debt-to-income (DTI) cap, usually at 43%.

- Non-QM: Much more lenient on debt. I frequently see approvals for borrowers with a DTI up to 50% or even 55%, allowing you to qualify for a more expensive home.

Secondary Market

- QM: These loans are almost always sold to government-sponsored entities like Fannie Mae or Freddie Mac.

- Non-QM: These are held by the lender in their portfolio or sold to private investors (hedge funds) and insurance companies.

Non-QM Loan FAQs

If you have more questions about non-QM loans, check out the FAQs below.

Q1. What property types are eligible for non-QM lending?

Non-QM is incredibly versatile regarding property types. You can finance primary residences, second homes, and investment properties. This includes Single-family homes, Townhomes, Multi-unit properties (2-4 units), and even tricky properties like non-warrantable condos and Condotels (condo-hotels) that conventional loans usually reject.

Q2. What are examples of non-QM loans?

The most common examples I handle are Bank Statement Loans (using 12-24 months of deposits for income), DSCR Loans (using rental income to qualify investment properties), Asset Depletion (using liquid savings as income), and Foreign National Loans for non-US citizens investing in the States.

Q6. Is a bank statement loan considered non-QM?

Yes, absolutely. It is the quintessential Non-QM product. Because it does not use standard tax returns or W-2s to verify income, as required by the "Qualified Mortgage" definition, it falls squarely into the Non-QM category. It is the go-to solution for self-employed borrowers.

Q7. What is non-qualified financing?

"Non-qualified financing" is just a broader industry term for Non-QM loans. It refers to any mortgage lending process that operates outside the "Safe Harbor" guidelines established by the CFPB. It simply means the loan doesn't meet the government's strict criteria for resale to Fannie Mae or Freddie Mac.

Conclusion

Here is the bottom line: Being rejected by a traditional bank does not mean you cannot buy a home. It often just means your financial life is more complex than a standard W-2 employee, and that is okay. Non-QM loans exist specifically to fill this gap, helping business owners and investors turn their real cash flow into real estate equity.

While the interest rates and down payments are slightly higher, I often advise my clients to view a Non-QM loan as a strategic bridge. You can use it to secure the property now, and then refinance into a conventional loan later if your tax profile changes or rates drop.

Since these loans are complex and rules vary by lender, your best move is to consult with an experienced Mortgage Broker who specializes in Non-QM products. They can navigate the "overlays" and find the program that fits your unique story.

People Also Read

- [Tips] Where to Buy Mortgage Leads? Warm Leads for LOs

- Detailed Guide: How to Become a Loan Officer with No Experience?

- 8 Best Mortgage Lead Generation Companies in 2026: Don't Miss

.svg)